Page 153 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 153

Accounting for Companies-I

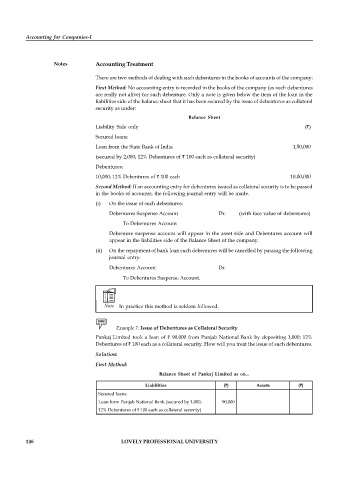

Notes Accounting Treatment

There are two methods of dealing with such debentures in the books of accounts of the company:

First Method: No accounting entry is recorded in the books of the company (as such debentures

are really not alive) for such debenture. Only a note is given below the item of the loan in the

liabilities side of the balance sheet that it has been secured by the issue of debentures as collateral

security as under:

Balance Sheet

Liability Side only ( )

Secured loans:

Loan from the State Bank of India 1,50,000

(secured by 2,000; 12% Debentures of 100 each as collateral security)

Debentures:

10,000; 12% Debentures of 100 each 10,00,000

Second Method: If an accounting entry for debentures issued as collateral security is to be passed

in the books of accounts, the following journal entry will be made.

(i) On the issue of such debentures:

Debentures Suspense Account Dr. (with face value of debentures)

To Debentures Account

Debenture suspense account will appear in the asset side and Debentures account will

appear in the liabilities side of the Balance Sheet of the company.

(ii) On the repayment of bank loan such debentures will be cancelled by passing the following

journal entry:

Debentures Account Dr.

To Debentures Suspense Account.

Note In practice this method is seldom followed.

Example 7: Issue of Debentures as Collateral Security

Pankaj Limited took a loan of 90,000 from Punjab National Bank by depositing 1,000; 12%

Debentures of 100 each as a collateral security. How will you treat the issue of such debentures.

Solution:

First Method:

Balance Sheet of Pankaj Limited as on...

Liabilities ( ) Assets ( )

Secured loans:

Loan form Punjab National Bank (secured by 1,000; 90,000

12% Debentures of 100 each as collateral security)

146 LOVELY PROFESSIONAL UNIVERSITY