Page 27 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 27

Accounting for Companies-I

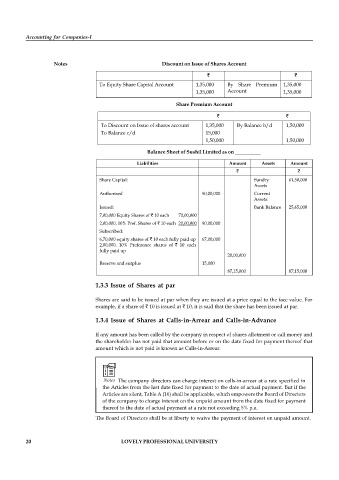

Notes Discount on Issue of Shares Account

To Equity Share Capital Account 1,35,000 By Share Premium 1,35,000

1,35,000 Account 1,35,000

Share Premium Account

To Discount on Issue of shares account 1,35,000 By Balance b/d 1,50,000

To Balance c/d 15,000

1,50,000 1,50,000

Balance Sheet of Sushil Limited as on __________

Liabilities Amount Assets Amount

Share Capital: Sundry 61,50,000

Assets

Authorised 90,00,000 Current

Assets:

Issued: Bank Balance 25,65,000

7,00,000 Equity Shares of 10 each 70,00,000

2,00,000, 10% Pref. Shares of 10 each 20,00,000 90,00,000

Subscribed:

6,70,000 equity shares of 10 each fully paid up 67,00,000

2,00,000, 10% Preference shares of 10 each

fully paid up

20,00,000

Reserve and surplus 15,000

87,15,000 87,15,000

1.3.3 Issue of Shares at par

Shares are said to be issued at par when they are issued at a price equal to the face value. For

example, if a share of 10 is issued at 10, it is said that the share has been issued at par.

1.3.4 Issue of Shares at Calls-in-Arrear and Calls-in-Advance

If any amount has been called by the company in respect of shares allotment or call money and

the shareholder has not paid that amount before or on the date fixed for payment thereof that

amount which is not paid is known as Calls-in-Arrear.

Notes The company directors can charge interest on calls-in-arrear at a rate specified in

the Articles from the last date fixed for payment to the date of actual payment. But if the

Articles are silent, Table A (16) shall be applicable, which empowers the Board of Directors

of the company to charge interest on the unpaid amount from the date fixed for payment

thereof to the date of actual payment at a rate not exceeding 5% p.a.

The Board of Directors shall be at liberty to waive the payment of interest on unpaid amount.

20 LOVELY PROFESSIONAL UNIVERSITY