Page 24 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 24

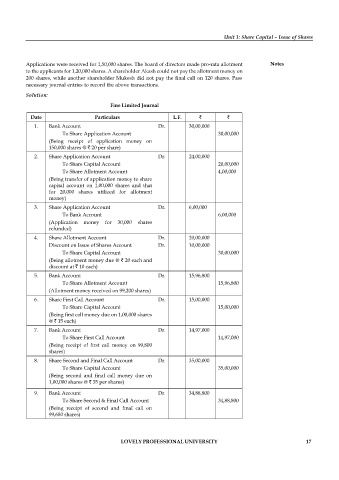

Unit 1: Share Capital – Issue of Shares

Applications were received for 1,50,000 shares. The board of directors made pro-rata allotment Notes

to the applicants for 1,20,000 shares. A shareholder Akash could not pay the allotment money on

200 shares, while another shareholder Mukesh did not pay the final call on 120 shares. Pass

necessary journal entries to record the above transactions.

Solution:

Fine Limited Journal

Date Particulars L.F.

1. Bank Account Dr. 30,00,000

To Share Application Account 30,00,000

(Being receipt of application money on

150,000 shares @ 20 per share)

2. Share Application Account Dr. 24,00,000

To Share Capital Account 20,00,000

To Share Allotment Account 4,00,000

(Being transfer of application money to share

capital account on 1,00,000 shares and that

for 20,000 shares utilized for allotment

money)

3. Share Application Account Dr. 6,00,000

To Bank Account 6,00,000

(Application money for 30,000 shares

refunded)

4. Share Allotment Account Dr. 20,00,000

Discount on Issue of Shares Account Dr. 10,00,000

To Share Capital Account 30,00,000

(Being allotment money due @ 20 each and

discount at 10 each)

5. Bank Account Dr. 15,96,800

To Share Allotment Account 15,96,800

(Allotment money received on 99,200 shares)

6. Share First Call Account Dr. 15,00,000

To Share Capital Account 15,00,000

(Being first call money due on 1,00,000 shares

@ 15 each)

7. Bank Account Dr. 14,97,000

To Share First Call Account 14,97,000

(Being receipt of first call money on 99,800

shares)

8. Share Second and Final Call Account Dr. 35,00,000

To Share Capital Account 35,00,000

(Being second and final call money due on

1,00,000 shares @ 35 per shares)

9. Bank Account Dr. 34,88,800

To Share Second & Final Call Account 34,88,800

(Being receipt of second and final call on

99,680 shares)

LOVELY PROFESSIONAL UNIVERSITY 17