Page 57 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 57

Accounting for Companies-I

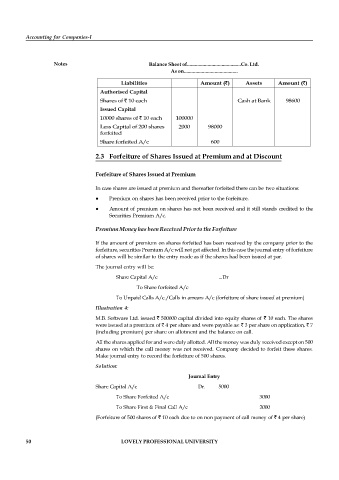

Notes Balance Sheet of..........................................Co. Ltd.

As on..........................................

Liabilities Amount ( ) Assets Amount ( )

Authorised Capital

Shares of 10 each Cash at Bank 98600

Issued Capital

10000 shares of 10 each 100000

Less Capital of 200 shares 2000 98000

forfeited

Share forfeited A/c 600

2.3 Forfeiture of Shares Issued at Premium and at Discount

Forfeiture of Shares Issued at Premium

In case shares are issued at premium and thereafter forfeited there can be two situations:

Premium on shares has been received prior to the forfeiture.

Amount of premium on shares has not been received and it still stands credited to the

Securities Premium A/c.

Premium Money has been Received Prior to the Forfeiture

If the amount of premium on shares forfeited has been received by the company prior to the

forfeiture, securities Premium A/c will not get affected. In this case the journal entry of forfeiture

of shares will be similar to the entry made as if the shares had been issued at par.

The journal entry will be:

Share Capital A/c ...Dr

To Share forfeited A/c

To Unpaid Calls A/c./Calls in arrears A/c (forfeiture of share issued at premium)

Illustration 4:

M.B. Software Ltd. issued 500000 capital divided into equity shares of 10 each. The shares

were issued at a premium of 4 per share and were payable as: 3 per share on application, 7

(including premium) per share on allotment and the balance on call.

All the shares applied for and were duly allotted. All the money was duly received except on 500

shares on which the call money was not received. Company decided to forfeit these shares.

Make journal entry to record the forfeiture of 500 shares.

Solution:

Journal Entry

Share Capital A/c Dr. 5000

To Share Forfeited A/c 3000

To Share First & Final Call A/c 2000

(Forfeiture of 500 shares of 10 each due to on non payment of call money of 4 per share)

50 LOVELY PROFESSIONAL UNIVERSITY