Page 71 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 71

Accounting for Companies-I

Notes

Notes In solving the examination problem, students generally face a difficulty in calculating

the amount of arrears on allotment and forfeited amount, in the case on shares are allotted

the basis of pro-rata.

In such a case the following procedure may be adopted to calculate these correct amounts and to

avoid difficulties:

1. Calculate the total number of shares applied for by the defaulters (if not given) as under.

2. Calculate the total amount of application money received by the company from the

defaulters, by multiplying the number of shares applied for by defaulters and application

money per share. This is the forfeited amount which would be transferred to the forfeited

shares account.

3. Calculate application money due on shares allotted to defaulters by multiplying the

shares allotted to defaulters and application money per share and deduct it from total

application money received. The result would be the excess application money to adjust in

allotment money.

4. Calculate the allotment money due to defaulters by multiplying the number of shares

allotted to defaulters and allotment money per share and deduct it from excess application

money received from defaulters (calculated above in No. 3). This will be the net amount of

arrears on allotment, which will be credited to share allotment account at the time of

forfeiture.

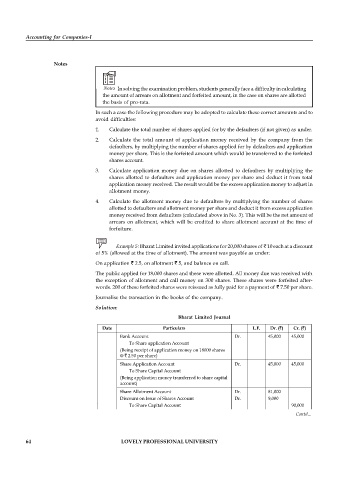

Example 5: Bharat Limited invited applications for 20,000 shares of 10 each at a discount

of 5% (allowed at the time of allotment). The amount was payable as under:

On application 2.5, on allotment 5, and balance on call.

The public applied for 18,000 shares and these were allotted. All money due was received with

the exception of allotment and call money on 300 shares. These shares were forfeited after-

words. 200 of these forfeited shares were reissued as fully paid for a payment of 7.50 per share.

Journalise the transaction in the books of the company.

Solution:

Bharat Limited Journal

Date Particulars L.F. Dr. ( ) Cr. ( )

Bank Account Dr. 45,000 45,000

To Share application Account

(Being receipt of application money on 18000 shares

@ 2.50 per share)

Share Application Account Dr. 45,000 45,000

To Share Capital Account

(Being application money transferred to share capital

account)

Share Allotment Account Dr. 81,000

Discount on Issue of Shares Account Dr. 9,000

To Share Capital Account 90,000

(Being allotment money due on 18,000 shares @ 5 Contd...

per share at a discount of 5%)

Bank Account Dr. 79,650

To Share Allotment Account 79,650

LOVELY PROFESSIONAL UNIVERSITY

64 (Being allotment money received on 1700 shares)

Share Final Call Account Dr. 45,000

To Share Capital Account 45,000

(Being final call money due on 18,000 shares 2.5 per

share)

Bank Account Dr. 44,250 44,250

To Share Final Call Account

(Being final call money received on 17,700 shares)

Share Capital Account Dr. 3,000

To Share Allotment Account. 1,350

To Share Final Call Account 750

To Discount on Issue of Shares Account 150

To Forfeited Shares Account 750

(Being forfeiture of 300 shares for non-payment of

allotment and final call money)

Bank Account Dr. 1,500

Discount on Issue of Shares Account Dr. 100

Forfeited Shares Account Dr. 400

To Share Capital Account 2,000

(Being reissue of 200 forfeited shares @ 7.5 per

shares as fully paid).

Forfeited Shares Account Dr. 100

To Capital Reserve Account 100

(Profit on reissue of 200 forfeited shares transferred.)