Page 153 - DCOM202_COST_ACCOUNTING_I

P. 153

Unit 7: Remuneration and Incentives

Total wages = ` 48Y + ` 6Y = ` 54Y Notes

Overheads = ` 20 per hour = ` 960

Total conversion cost is ` 54Y + 960 = ` 1500

So Y = ` 10

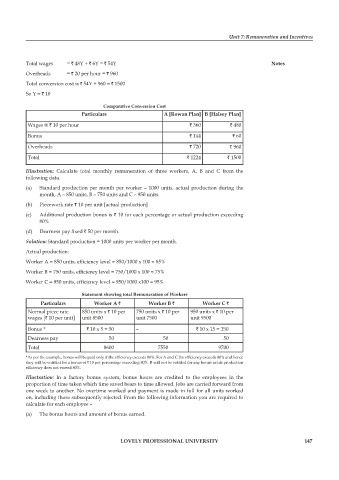

Comparative Conversion Cost

Particulars A [Rowan Plan] B [Halsey Plan]

Wages @ ` 10 per hour ` 360 ` 480

Bonus ` 144 ` 60

Overheads ` 720 ` 960

Total ` 1224 ` 1500

Illustration: Calculate total monthly remuneration of three workers, A, B and C from the

following data.

(a) Standard production per month per worker – 1000 units, actual production during the

month, A – 850 units, B – 750 units and C – 950 units.

(b) Piecework rate ` 10 per unit [actual production]

(c) Additional production bonus is ` 10 for each percentage or actual production exceeding

80%

(d) Dearness pay fixed ` 50 per month.

Solution: Standard production = 1000 units per worker per month.

Actual production:

Worker A = 850 units, efficiency level = 850/1000 x 100 = 85%

Worker B = 750 units, efficiency level = 750/1000 x 100 = 75%

Worker C = 950 units, efficiency level = 950/1000 x100 = 95%

Statement showing total Remuneration of Workers

Particulars Worker A ` Worker B ` Worker C `

Normal piece rate 850 units x ` 10 per 750 units x ` 10 per 950 units x ` 10 per

wages [` 10 per unit] unit 8500 unit 7500 unit 9500

Bonus * ` 10 x 5 = 50 – ` 10 x 15 = 150

Dearness pay 50 50 50

Total 8600 7550 9700

*As per the example, bonus will be paid only if the efficiency exceeds 80%. For A and C the efficiency exceeds 80% and hence

they will be entitled for a bonus of ` 10 per percentage exceeding 80%. B will not be entitled for any bonus as his production

efficiency does not exceed 80%.

Illustration: In a factory bonus system, bonus hours are credited to the employees in the

proportion of time taken which time saved bears to time allowed. Jobs are carried forward from

one week to another. No overtime worked and payment is made in full for all units worked

on, including those subsequently rejected. From the following information you are required to

calculate for each employee –

(a) The bonus hours and amount of bonus earned.

LOVELY PROFESSIONAL UNIVERSITY 147