Page 240 - DCOM202_COST_ACCOUNTING_I

P. 240

Cost Accounting – I

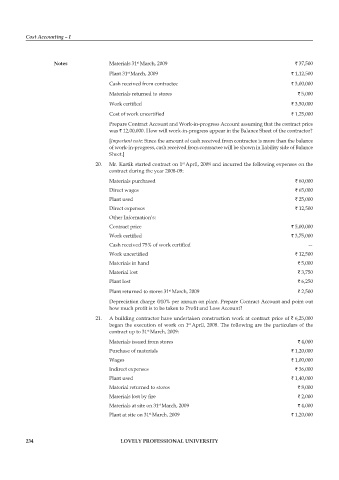

Notes Materials 31 March, 2009 ` 37,500

st

plant 31 March, 2009 ` 1,12,500

st

Cash received from contractee ` 3,00,000

Materials returned to stores ` 5,000

Work certified ` 3,50,000

Cost of work uncertified ` 1,25,000

Prepare Contract Account and Work-in-progress Account assuming that the contract price

was ` 12,00,000. How will work-in-progress appear in the Balance Sheet of the contractor?

[Important note: Since the amount of cash received from contractee is more than the balance

of work-in-progress, cash received from contractee will be shown in liability side of Balance

Sheet.]

20. Mr. Kartik started contract on 1 April, 2008 and incurred the following expenses on the

st

contract during the year 2008-09:

Materials purchased ` 60,000

Direct wages ` 65,000

plant used ` 25,000

Direct expenses ` 12,500

Other Information’s:

Contract price ` 5,00,000

Work certified ` 3,75,000

Cash received 75% of work certified —

Work uncertified ` 12,500

Materials in hand ` 5,000

Material lost ` 3,750

plant lost ` 6,250

plant returned to stores 31 March, 2009 ` 2,500

st

Depreciation charge @10% per annum on plant. prepare Contract Account and point out

how much profit is to be taken to Profit and Loss Account?

21. A building contractor have undertaken construction work at contract price of ` 6,25,000

began the execution of work on 1 April, 2008. The following are the particulars of the

st

contract up to 31 March, 2009:

st

Materials issued from stores ` 4,000

purchase of materials ` 1,20,000

Wages ` 1,00,000

Indirect expenses ` 36,000

plant used ` 1,40,000

Material returned to stores ` 8,000

Materials lost by fire ` 2,000

Materials at site on 31 March, 2009 ` 4,000

st

plant at site on 31 March, 2009 ` 1,20,000

st

234 LOVELY PROFESSIONAL UNIVERSITY