Page 235 - DCOM202_COST_ACCOUNTING_I

P. 235

Unit 11: Contract Costing

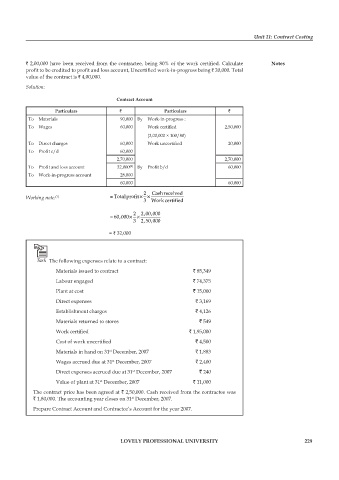

` 2,00,000 have been received from the contractee, being 80% of the work certified. Calculate Notes

profit to be credited to profit and loss account, Uncertified work-in-progress being ` 20,000. Total

value of the contract is ` 4,00,000.

Solution:

Contract Account

Particulars ` Particulars `

To Materials 90,000 By Work-in-progress :

To Wages 60,000 Work certified 2,50,000

(2,00,000 × 100/80)

To Direct charges 60,000 Work uncertified 20,000

To Profit c/d 60,000

2,70,000 2,70,000

To Profit and loss account 32,000 (1) By Profit b/d 60,000

To Work-in-progress account 28,000

60,000 60,000

2 Cashreceived

Working note: (1) = × Totalprofit ×

3 Work certified

2 200 000

,

,

= , × 60 000 ×

,

,

3 250 000

= ` 32,000

Task The following expenses relate to a contract:

Materials issued to contract ` 85,349

Labour engaged ` 74,375

plant at cost ` 15,000

Direct expenses ` 3,169

Establishment charges ` 4,126

Materials returned to stores ` 549

Work certified ` 1,95,000

Cost of work uncertified ` 4,500

Materials in hand on 31 December, 2007 ` 1,883

st

Wages accrued due at 31 December, 2007 ` 2,400

st

Direct expenses accrued due at 31 December, 2007 ` 240

st

st

Value of plant at 31 December, 2007 ` 11,000

The contract price has been agreed at ` 2,50,000. Cash received from the contractee was

` 1,80,000. The accounting year closes on 31 December, 2007.

st

prepare Contract Account and Contractee’s Account for the year 2007.

LOVELY PROFESSIONAL UNIVERSITY 229