Page 232 - DCOM202_COST_ACCOUNTING_I

P. 232

Cost Accounting – I

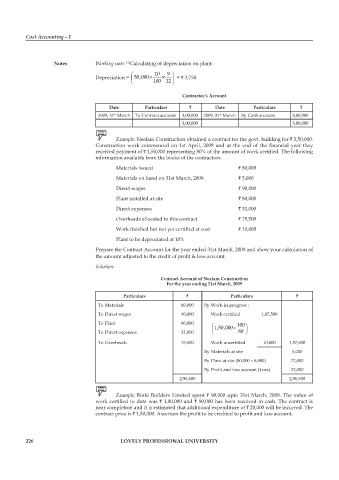

Notes Working note: Calculating of depreciation on plant:

(1)

10 9

Depreciation = 50 000, × × = ` 3,750.

100 12

Contractee’s Account

date Particulars ` date Particulars `

st

2009, 31 March To Contract account 3,00,000 2009, 31 March By Cash account 3,00,000

st

3,00,000 3,00,000

Example: Neelam Construction obtained a contract for the govt. building for ` 3,50,000.

Construction work commenced on 1st April, 2008 and at the end of the financial year they

received payment of ` 1,50,000 representing 80% of the amount of work certified. The following

information available from the books of the contractors:

Materials issued ` 80,000

Materials on hand on 31st March, 2009 ` 5,000

Direct wages ` 90,000

plant installed at site ` 80,000

Direct expenses ` 31,000

Overheads allocated to this contract ` 15,500

Work finished but not yet certified at cost ` 10,000

plant to be depreciated at 10%

prepare the Contract Account for the year ended 31st March, 2009 and show your calculation of

the amount adjusted to the credit of profit & loss account.

Solution:

Contract Account of Neelam Construction

For the year ending 31st March, 2009

Particulars ` Particulars `

To Materials 80,000 By Work-in-progress :

To Direct wages 90,000 Work certified 1,87,500

To plant 80,000 150 000× 100

,

,

To Direct expenses 31,000 80

To Overheads 15,500 Work uncertified 10,000 1,97,500

By Materials at site 5,000

By plant at site (80,000 – 8,000) 72,000

By Profit and loss account (Loss) 22,000

2,96,500 2,96,500

Example: Rinki Builders Limited spent ` 90,000 upto 31st March, 2009. The value of

work certified to data was ` 1,00,000 and ` 90,000 has been received in cash. The contract is

near completion and it is estimated that additional expenditure of ` 20,000 will be incurred. The

contract price is ` 1,50,000. Ascertain the profit to be credited to profit and loss account.

226 LOVELY PROFESSIONAL UNIVERSITY