Page 231 - DCOM202_COST_ACCOUNTING_I

P. 231

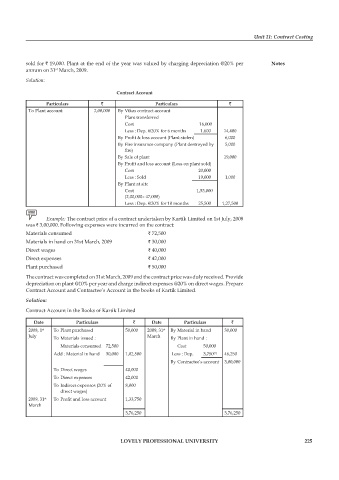

Unit 11: Contract Costing

sold for ` 19,000. plant at the end of the year was valued by charging depreciation @20% per Notes

annum on 31 March, 2009.

st

Solution:

Contract Account

Particulars ` Particulars `

To plant account 2,00,000 By Vikas contract account

plant transferred

Cost 16,000

Less : Dep. @20% for 6 months 1,600 14,400

By Profit & loss account (Plant stolen) 6,000

By Fire insurance company (plant destroyed by 5,000

fire)

By Sale of plant 19,000

By Profit and loss account (Loss on plant sold)

Cost 20,000

Less : Sold 19,000 1,000

By plant at site

Cost 1,53,000

(2,00,000– 47,000)

Less : Dep. @20% for 10 months 25,500 1,27,500

Example: The contract price of a contract undertaken by Kartik Limited on 1st July, 2008

was ` 3,00,000. Following expenses were incurred on the contract:

Materials consumed ` 72,500

Materials in hand on 31st March, 2009 ` 30,000

Direct wages ` 40,000

Direct expenses ` 42,000

plant purchased ` 50,000

The contract was completed on 31st March, 2009 and the contract price was duly received. provide

depreciation on plant @10% per year and charge indirect expenses @20% on direct wages. prepare

Contract Account and Contractee’s Account in the books of Kartik Limited.

Solution:

Contract Account in the Books of Kartik Limited

date Particulars ` date Particulars `

st

st

2008, 1 To plant purchased 50,000 2009, 31 By Material in hand 30,000

July To Materials issued : March By plant in hand :

Materials consumed 72,500 Cost 50,000

Add : Material in hand 30,000 1,02,500 Less : Dep. 3,750 (1) 46,250

By Contractee’s account 3,00,000

To Direct wages 40,000

To Direct expenses 42,000

To Indirect expenses (20% of 8,000

direct wages)

2009, 31 To Profit and loss account 1,33,750

st

March

3,76,250 3,76,250

LOVELY PROFESSIONAL UNIVERSITY 225