Page 233 - DCOM202_COST_ACCOUNTING_I

P. 233

Unit 11: Contract Costing

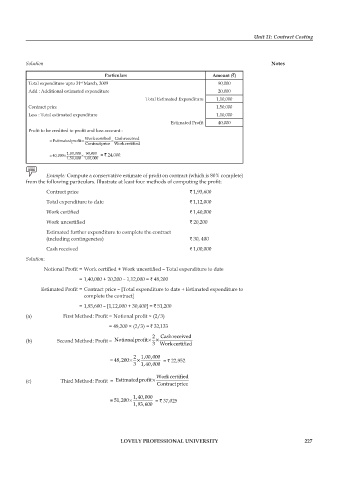

Solution Notes

Particulars Amount (`)

Total expenditure upto 31 March, 2009 90,000

st

Add : Additional estimated expenditure 20,000

Total Estimated Expenditure 1,10,000

Contract price 1,50,000

Less : Total estimated expenditure 1,10,000

Estimated Profit 40,000

Profit to be credited to profit and loss account :

Workcertified Cashreceived

= Estimatedprofit × ×

r

Contractprice Workcertified

,

,

1 00 000 90 000

,

,

= 40 000 × × = ` 24,000.

,

,

,

,

1 50 000 1 00 000

Example: Compute a conservative estimate of profit on contract (which is 80% complete)

from the following particulars. Illustrate at least four methods of computing the profit:

Contract price ` 1,93,600

Total expenditure to date ` 1,12,000

Work certified ` 1,40,000

Work uncertified ` 20,200

Estimated further expenditure to complete the contract

(including contingencies) ` 30, 400

Cash received ` 1,00,000

Solution:

Notional Profit = Work certified + Work uncertified – Total expenditure to date

= 1,40,000 + 20,200 – 1,12,000 = ` 48,200

Estimated Profit = Contract price – [Total expenditure to date + Estimated expenditure to

complete the contract]

= 1,93,600 – [1,12,000 + 30,400] = ` 51,200

(a) First Method: Profit = Notional profit × (2/3)

= 48,200 × (2/3) = ` 32,133

2 Cashreceived

(b) Second Method: Profit = Notionalprofit×× Work certified

3

,

,

2 100 000

= , × 48 200 × = ` 22,952

,

,

3 140 000

Work certified

(c) Third Method: Profit = Estimatedprofit×

Contractprice

,

,

140 000

= , × 51 200 = ` 37,025

,

,

193 600

LOVELY PROFESSIONAL UNIVERSITY 227