Page 246 - DCOM202_COST_ACCOUNTING_I

P. 246

Cost Accounting – I

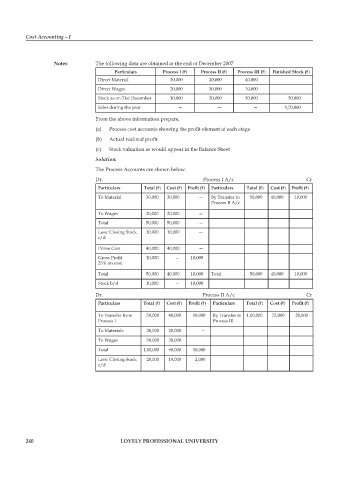

Notes The following data are obtained at the end of December 2007

Particulars Process I (`) Process II (`) Process III (`) Finished Stock (`)

Direct Material 30,000 20,000 40,000

Direct Wages 20,000 30,000 10,000

Stock as on 31st December 10,000 20,000 30,000 30,000

Sales during the year — — — 1,70,000

From the above information prepare,

(a) Process cost accounts showing the profit element at each stage

(b) Actual realized profit

(c) Stock valuation as would appear in the Balance Sheet

Solution:

The process Accounts are shown below.

Dr. process I A/c Cr

Particulars Total (`) Cost (`) Profit (`) Particulars Total (`) Cost (`) Profit (`)

To Material 30,000 30,000 — By Transfer to 50,000 40,000 10,000

process II A/c

To Wages 20,000 20,000 —

Total 50,000 50,000 —

Less: Closing Stock 10,000 10,000 —

c/d

prime Cost 40,000 40,000 —

Gross Profit 10,000 — 10,000

25% on cost

Total 50,000 40,000 10,000 Total 50,000 40,000 10,000

Stock b/d 10,000 — 10,000

Dr. process II A/c Cr

Particulars Total (`) Cost (`) Profit (`) Particulars Total (`) Cost (`) Profit (`)

To Transfer from 50,000 40,000 10,000 By Transfer to 1,00,000 72,000 28,000

process I process III

To Materials 20,000 20,000 —

To Wages 30,000 30,000

Total 1,00,000 90,000 10,000

Less: Closing Stock 20,000 18,000 2,000

c/d

240 LOVELY PROFESSIONAL UNIVERSITY