Page 249 - DCOM202_COST_ACCOUNTING_I

P. 249

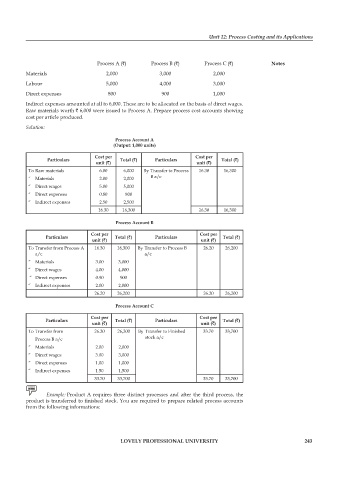

Unit 12: Process Costing and its Applications

process A (`) process B (`) process C (`) Notes

Materials 2,000 3,000 2,000

Labour 5,000 4,000 3,000

Direct expenses 800 900 1,000

Indirect expenses amounted at all to 6,000. These are to be allocated on the basis of direct wages.

Raw materials worth ` 6,000 were issued to process A. prepare process cost accounts showing

cost per article produced.

Solution:

Process Account A

(Output: 1,000 units)

Cost per Cost per

Particulars Total (`) Particulars Total (`)

unit (`) unit (`)

To Raw materials 6.00 6,000 By Transfer to process 16.30 16,300

“ Materials 2.00 2,000 B a/c

“ Direct wages 5.00 5,000

“ Direct expenses 0.80 800

“ Indirect expenses 2.50 2,500

16.30 16,300 16.30 16,300

Process Account B

Cost per Cost per

Particulars Total (`) Particulars Total (`)

unit (`) unit (`)

To Transfer from process A 16.30 16,300 By Transfer to process B 26.20 26,200

a/c a/c

“ Materials 3.00 3,000

“ Direct wages 4.00 4,000

“ Direct expenses 0.90 900

“ Indirect expenses 2.00 2,000

26.20 26,200 26.20 26,200

Process Account C

Cost per Cost per

Particulars Total (`) Particulars Total (`)

unit (`) unit (`)

To Transfer from 26.20 26,200 By Transfer to Finished 33.70 33,700

process B a/c stock a/c

“ Materials 2.00 2,000

“ Direct wages 3.00 3,000

“ Direct expenses 1.00 1,000

“ Indirect expenses 1.50 1,500

33.70 33,700 33.70 33,700

Example: product A requires three distinct processes and after the third process, the

product is transferred to finished stock. You are required to prepare related process accounts

from the following informations:

LOVELY PROFESSIONAL UNIVERSITY 243