Page 253 - DCOM202_COST_ACCOUNTING_I

P. 253

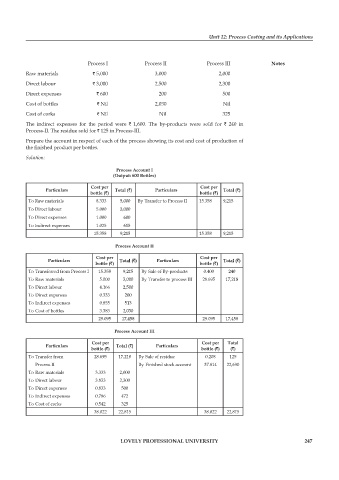

Unit 12: Process Costing and its Applications

process I process II process III Notes

Raw materials ` 5,000 3,000 2,000

Direct labour ` 3,000 2,500 2,300

Direct expenses ` 600 200 500

Cost of bottles ` Nil 2,030 Nil

Cost of corks ` Nil Nil 325

The indirect expenses for the period were ` 1,600. The by-products were sold for ` 240 in

process-II. The residue sold for ` 125 in process-III.

prepare the account in respect of each of the process showing its cost and cost of production of

the finished product per bottles.

Solution:

Process Account I

(Output: 600 Bottles)

Cost per Cost per

Particulars Total (`) Particulars Total (`)

bottle (`) bottle (`)

To Raw materials 8.333 5,000 By Transfer to process II 15.358 9,215

To Direct labour 5.000 3,000

To Direct expenses 1.000 600

To Indirect expenses 1.025 615

15.358 9,215 15.358 9,215

Process Account II

Cost per Cost per

Particulars Total (`) Particulars Total (`)

bottle (`) bottle (`)

To Transferred from process I 15.358 9,215 By Sale of By-products 0.400 240

To Raw materials 5.000 3,000 By Transfer to process III 28.695 17,218

To Direct labour 4.166 2,500

To Direct expenses 0.333 200

To Indirect expenses 0.855 513

To Cost of bottles 3.383 2,030

29.095 17,458 29.095 17,458

Process Account III

Cost per Cost per Total

Particulars Total (`) Particulars

bottle (`) bottle (`) (`)

To Transfer from 28.695 17,218 By Sale of residue 0.208 125

process II By Finished stock account 37.814 22,690

To Raw materials 3.333 2,000

To Direct labour 3.833 2,300

To Direct expenses 0.833 500

To Indirect expenses 0.786 472

To Cost of corks 0.542 325

38.022 22,815 38.022 22,815

LOVELY PROFESSIONAL UNIVERSITY 247