Page 258 - DCOM202_COST_ACCOUNTING_I

P. 258

Cost Accounting – I

Notes process A process B

Materials consumed (Tons) 1,000 70

Cost of materials per ton ` 200 ` 300

Manufacturing wages ` 20,000 ` 15,000

Manufacturing expenses ` 6,000 ` 4,000

prepare process cost accounts, showing the cost of the output of each process and the cost per ton.

Solution:

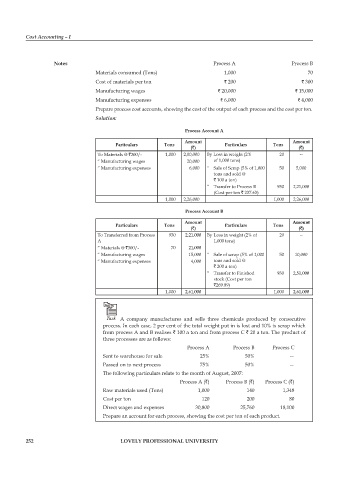

Process Account A

Amount Amount

Particulars Tons Particulars Tons

(`) (`)

To Materials @ `200/- 1,000 2,00,000 By Loss in weight (2% 20 —

“ Manufacturing wages 20,000 of 1,000 tons)

“ Manufacturing expenses 6,000 “ Sale of Scrap (5% of 1,000 50 5,000

tons and sold @

` 100 a ton)

“ Transfer to Process B 930 2,21,000

(Cost per ton ` 237.63)

1,000 2,26,000 1,000 2,26,000

Process Account B

Amount Amount

Particulars Tons Particulars Tons

(`) (`)

To Transferred from process 930 2,21,000 By Loss in weight (2% of 20 —

A 1,000 tons)

“ Materials @ `300/- 70 21,000

“ Manufacturing wages 15,000 “ Sale of scrap (5% of 1,000 50 10,000

“ Manufacturing expenses 4,000 tons and sold @

` 200 a ton)

“ Transfer to Finished 930 2,51,000

stock (Cost per ton

`269.89)

1,000 2,61,000 1,000 2,61,000

Task A company manufactures and sells three chemicals produced by consecutive

process. In each case, 2 per cent of the total weight put in is lost and 10% is scrap which

from process A and B realises ` 100 a ton and from process C ` 20 a ton. The product of

three processes are as follows:

process A process B process C

Sent to warehouse for sale 25% 50% —

passed on to next process 75% 50% —

The following particulars relate to the month of August, 2007:

process A (`) process B (`) process C (`)

Raw materials used (Tons) 1,000 140 1,348

Cost per ton 120 200 80

Direct wages and expenses 30,800 25,760 18,100

prepare an account for each process, showing the cost per ton of each product.

252 LOVELY PROFESSIONAL UNIVERSITY