Page 261 - DCOM202_COST_ACCOUNTING_I

P. 261

Unit 12: Process Costing and its Applications

The indirect expenses for the period amount to ` 6,000 in the factory out of which ` 2,000 Notes

is attributable to this product. There was no stock at the end in any process. The indirect

expenses should be allocated to each process on the basis of direct wages.

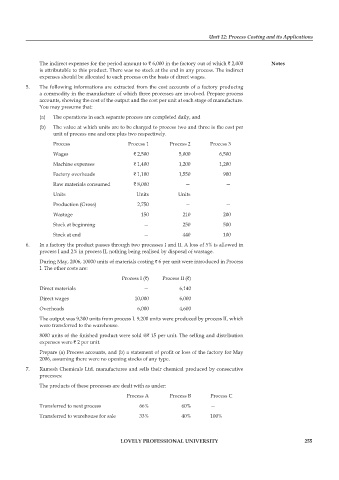

5. The following informations are extracted from the cost accounts of a factory producing

a commodity in the manufacture of which three processes are involved. prepare process

accounts, showing the cost of the output and the cost per unit at each stage of manufacture.

You may presume that:

(a) The operations in each separate process are completed daily, and

(b) The value at which units are to be charged to process two and three is the cost per

unit of process one and one plus two respectively.

process process 1 process 2 process 3

Wages ` 2,500 5,000 6,500

Machine expenses ` 1,400 1,200 1,200

Factory overheads ` 1,100 1,550 900

Raw materials consumed ` 8,000 — —

Units Units Units

production (Gross) 2,750 — —

Wastage 150 210 200

Stock at beginning — 250 500

Stock at end — 440 100

6. In a factory the product passes through two processes I and II. A loss of 5% is allowed in

process I and 2% in process II, nothing being realised by disposal of wastage.

During May, 2006, 10000 units of materials costing ` 6 per unit were introduced in process

I. The other costs are:

process I (`) process II (`)

Direct materials — 6,140

Direct wages 10,000 6,000

Overheads 6,000 4,600

The output was 9,300 units from process I. 9,200 units were produced by process II, which

were transferred to the warehouse.

8000 units of the finished product were sold @` 15 per unit. The selling and distribution

expenses were ` 2 per unit.

Prepare (a) Process accounts, and (b) a statement of profit or loss of the factory for May

2006, assuming there were no opening stocks of any type.

7. Ramesh Chemicals Ltd. manufactures and sells their chemical produced by consecutive

processes:

The products of these processes are dealt with as under:

process A process B process C

Transferred to next process 66% 60% —

Transferred to warehouse for sale 33% 40% 100%

LOVELY PROFESSIONAL UNIVERSITY 255