Page 256 - DCOM202_COST_ACCOUNTING_I

P. 256

Cost Accounting – I

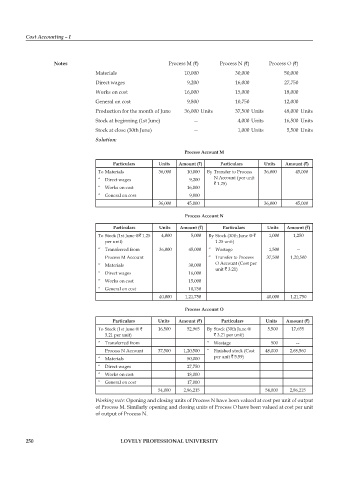

Notes process M (`) process N (`) process O (`)

Materials 10,000 30,000 50,000

Direct wages 9,200 16,000 27,750

Works on cost 16,000 15,000 18,000

General on cost 9,800 10,750 12,000

production for the month of June 36,000 Units 37,500 Units 48,000 Units

Stock at beginning (1st June) — 4,000 Units 16,500 Units

Stock at close (30th June) — 1,000 Units 5,500 Units

Solution:

Process Account M

Particulars Units Amount (`) Particulars Units Amount (`)

To Materials 36,000 10,000 By Transfer to process 36,000 45,000

“ Direct wages 9,200 N Account (per unit

` 1.25)

“ Works on cost 16,000

“ General on cost 9,800

36,000 45,000 36,000 45,000

Process Account N

Particulars Units Amount (`) Particulars Units Amount (`)

To Stock (1st June @` 1.25 4,000 5,000 By Stock (30th June @ ` 1,000 1,250

per unit) 1.25 unit)

“ Transferred from 36,000 45,000 “ Wastage 1,500 —

process M Account “ Transfer to Process 37,500 1,20,500

“ Materials 30,000 O Account (Cost per

unit ` 3.21)

“ Direct wages 16,000

“ Works on cost 15,000

“ General on cost 10,750

40,000 1,21,750 40,000 1,21,750

Process Account O

Particulars Units Amount (`) Particulars Units Amount (`)

To Stock (1st June @ ` 16,500 52,965 By Stock (30th June @ 5,500 17,655

3.21 per unit) ` 3.21 per unit)

“ Transferred from “ Wastage 500 —

process N Account 37,500 1,20,500 “ Finished stock (Cost 48,000 2,68,560

“ Materials 50,000 per unit ` 5.59)

“ Direct wages 27,750

“ Works on cost 18,000

“ General on cost 17,000

54,000 2,86,215 54,000 2,86,215

Working note: Opening and closing units of process N have been valued at cost per unit of output

of process M. Similarly opening and closing units of process O have been valued at cost per unit

of output of process N.

250 LOVELY PROFESSIONAL UNIVERSITY