Page 255 - DCOM202_COST_ACCOUNTING_I

P. 255

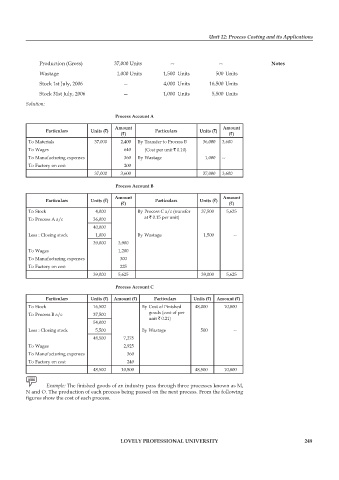

Unit 12: Process Costing and its Applications

production (Gross) 37,000 Units — — Notes

Wastage 1,000 Units 1,500 Units 500 Units

Stock 1st July, 2006 — 4,000 Units 16,500 Units

Stock 31st July, 2006 — 1,000 Units 5,500 Units

Solution:

Process Account A

Amount Amount

Particulars Units (`) Particulars Units (`)

(`) (`)

To Materials 37,000 2,400 By Transfer to process B 36,000 3,600

To Wages 640 (Cost per unit ` 0.10)

To Manufacturing expenses 360 By Wastage 1,000 --

To Factory on cost 200

37,000 3,600 37,000 3,600

Process Account B

Amount Amount

Particulars Units (`) Particulars Units (`)

(`) (`)

To Stock 4,000 By process C a/c (transfer 37,500 5,625

To process A a/c 36,000 at ` 0.15 per unit)

40,000

Less : Closing stock 1,000 By Wastage 1,500 --

39,000 3,900

To Wages 1,200

To Manufacturing expenses 300

To Factory on cost 225

39,000 5,625 39,000 5,625

Process Account C

Particulars Units (`) Amount (`) Particulars Units (`) Amount (`)

To Stock 16,500 By Cost of Finished 48,000 10,800

To process B a/c 37,500 goods (cost of per

unit ` 0.21)

54,000

Less : Closing stock 5,500 By Wastage 500 --

48,500 7,275

To Wages 2,925

To Manufacturing expenses 360

To Factory on cost 240

48,500 10,800 48,500 10,800

Example: The finished goods of an industry pass through three processes known as M,

N and O. The production of each process being passed on the next process. From the following

figures show the cost of each process.

LOVELY PROFESSIONAL UNIVERSITY 249