Page 185 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 185

Accounting for Companies – II

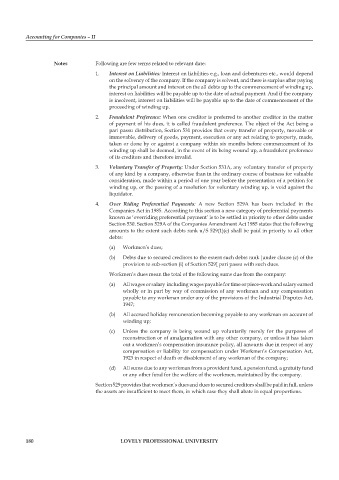

notes Following are few terms related to relevant date:

1. Interest on Liabilities: Interest on liabilities e.g., loan and debentures etc., would depend

on the solvency of the company. If the company is solvent, and there is surplus after paying

the principal amount and interest on the all debts up to the commencement of winding up,

interest on liabilities will be payable up to the date of actual payment. And if the company

is insolvent, interest on liabilities will be payable up to the date of commencement of the

proceeding of winding up.

2. Fraudulent Preference: When one creditor is preferred to another creditor in the matter

of payment of his dues, it is called fraudulent preference. The object of the Act being a

pari passu distribution, Section 531 provides that every transfer of property, movable or

immovable, delivery of goods, payment, execution or any act relating to property, made,

taken or done by or against a company within six months before commencement of its

winding up shall be deemed, in the event of its being wound up, a fraudulent preference

of its creditors and therefore invalid.

3. Voluntary Transfer of Property: Under Section 531A, any voluntary transfer of property

of any kind by a company, otherwise than in the ordinary course of business for valuable

consideration, made within a period of one year before the presentation of a petition for

winding up, or the passing of a resolution for voluntary winding up, is void against the

liquidator.

4. Over Riding Preferential Payments: A new Section 529A has been included in the

Companies Act in 1985. According to this section a new category of preferential payments

known as ‘overriding preferential payment’ is to be settled in priority to other debts under

Section 530. Section 529A of the Companies Amendment Act 1985 states that the following

amounts to the extent such debts rank u/S 529(1)(c) shall be paid in priority to all other

debts:

(a) Workmen’s dues;

(b) Debts due to secured creditors to the extent such debts rank [under clause (c) of the

provision to sub-section (i) of Section 529] pari passu with such dues.

Workmen’s dues mean the total of the following sums due from the company:

(a) All wages or salary including wages payable for time or piece-work and salary earned

wholly or in part by way of commission of any workman and any compensation

payable to any workman under any of the provisions of the Industrial Disputes Act,

1947;

(b) All accrued holiday remuneration becoming payable to any workman on account of

winding up;

(c) Unless the company is being wound up voluntarily merely for the purposes of

reconstruction or of amalgamation with any other company, or unless it has taken

out a workmen’s compensation insurance policy, all amounts due in respect of any

compensation or liability for compensation under Workmen’s Compensation Act,

1923 in respect of death or disablement of any workman of the company;

(d) All sums due to any workman from a provident fund, a pension fund, a gratuity fund

or any other fund for the welfare of the workmen, maintained by the company.

Section 529 provides that workmen’s dues and dues to secured creditors shall be paid in full, unless

the assets are insufficient to meet them, in which case they shall abate in equal proportions.

180 lovely professional university