Page 193 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 193

Accounting for Companies – II

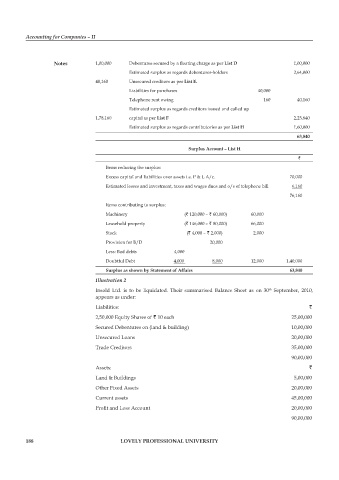

notes 1,00,000 Debentures secured by a floating charge as per list D 1,00,000

Estimated surplus as regards debentures-holders 2,64,000

40,160 Unsecured creditors as per list e.

Liabilities for purchases 40,000

Telephone rent owing 160 40,160

Estimated surplus as regards creditors issued and called up

1,78,160 capital as per list f 2,23,840

Estimated surplus as regards contributories as per list H 1,60,000

63,840

surplus account – list H

`

Items reducing the surplus:

Excess capital and liabilities over assets i.e. P & L A/c. 70,000

Estimated losses and investment, taxes and wages dues and o/s of telephone bill 6,160

76,160

Items contributing to surplus:

Machinery (` 120,000 – ` 60,000) 60,000

Leasehold property (` 146,000 – ` 80,000) 66,000

Stock (` 4,000 – ` 2,000) 2,000

Provision for B/D 20,000

Less: Bad debts 4,000

Doubtful Debt 4,000 8,000 12,000 1,40,000

surplus as shown by statement of affairs 63,840

Illustration 2

Insold Ltd. is to be liquidated. Their summarised Balance Sheet as on 30 September, 2010,

th

appears as under:

Liabilities: `

2,50,000 Equity Shares of ` 10 each 25,00,000

Secured Debentures on (land & building) 10,00,000

Unsecured Loans 20,00,000

Trade Creditors 35,00,000

90,00,000

Assets: `

Land & Buildings 5,00,000

Other Fixed Assets 20,00,000

Current assets 45,00,000

Profit and Loss Account 20,00,000

90,00,000

188 lovely professional university