Page 195 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 195

Accounting for Companies – II

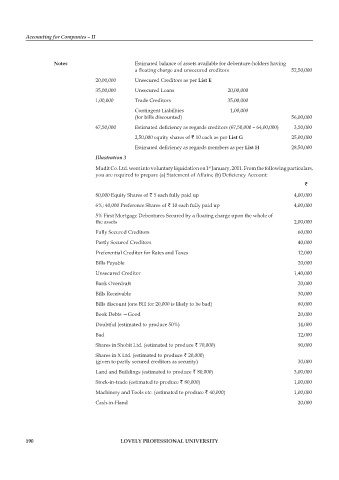

notes Estimated balance of assets available for debenture-holders having

a floating charge and unsecured creditors 52,50,000

20,00,000 Unsecured Creditors as per list e

35,00,000 Unsecured Loans 20,00,000

1,00,000 Trade Creditors 35,00,000

Contingent Liabilities 1,00,000

(for bills discounted) 56,00,000

67,50,000 Estimated deficiency as regards creditors (67,50,000 – 64,00,000) 3,50,000

2,50,000 equity shares of ` 10 each as per list g 25,00,000

Estimated deficiency as regards members as per list H 28,50,000

Illustration 3

Mudit Co. Ltd. went into voluntary liquidation on 1 January, 2011. From the following particulars,

st

you are required to prepare (a) Statement of Affairs; (b) Deficiency Account:

`

80,000 Equity Shares of ` 5 each fully paid up 4,00,000

6%; 40,000 Preference Shares of ` 10 each fully paid up 4,00,000

5% First Mortgage Debentures Secured by a floating charge upon the whole of

the assets 2,00,000

Fully Secured Creditors 60,000

Partly Secured Creditors 40,000

Preferential Creditor for Rates and Taxes 12,000

Bills Payable 20,000

Unsecured Creditor 1,40,000

Bank Overdraft 20,000

Bills Receivable 30,000

Bills discount (one Bill for 20,000 is likely to be bad) 80,000

Book Debts —Good 20,000

Doubtful (estimated to produce 50%) 14,000

Bad 12,000

Shares in Shobit Ltd. (estimated to produce ` 70,000) 90,000

Shares in X Ltd. (estimated to produce ` 20,000)

(given to partly secured creditors as security) 30,000

Land and Buildings (estimated to produce ` 80,000) 3,00,000

Stock-in-trade (estimated to produce ` 80,000) 1,00,000

Machinery and Tools etc. (estimated to produce ` 40,000) 1,00,000

Cash-in-Hand 20,000

190 lovely professional university