Page 200 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 200

Unit 9: Fundamentals of Liquidation of Companies

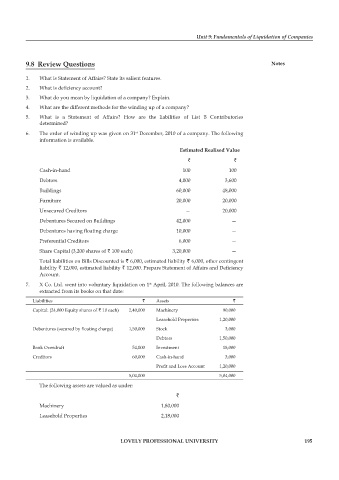

9.8 review Questions notes

1. What is Statement of Affairs? State its salient features.

2. What is deficiency account?

3. What do you mean by liquidation of a company? Explain.

4. What are the different methods for the winding up of a company?

5. What is a Statement of Affairs? How are the liabilities of List B Contributories

determined?

st

6. The order of winding up was given on 31 December, 2010 of a company. The following

information is available.

estimated realised value

` `

Cash-in-hand 100 100

Debtors 4,000 3,600

Buildings 60,000 48,000

Furniture 20,000 20,000

Unsecured Creditors — 20,000

Debentures Secured on Buildings 42,000 —

Debentures having floating charge 10,000 —

Preferential Creditors 6,000 —

Share Capital (3,200 shares of ` 100 each) 3,20,000 —

Total liabilities on Bills Discounted is ` 6,000, estimated liability ` 6,000, other contingent

liability ` 12,000, estimated liability ` 12,000. Prepare Statement of Affairs and Deficiency

Account.

7. X Co. Ltd. went into voluntary liquidation on 1 April, 2010. The following balances are

st

extracted from its books on that date:

Liabilities ` Assets `

Capital: (24,000 Equity shares of ` 10 each) 2,40,000 Machinery 90,000

Leasehold Properties 1,20,000

Debentures (secured by floating charge) 1,50,000 Stock 3,000

Debtors 1,50,000

Bank Overdraft 54,000 Investment 18,000

Creditors 60,000 Cash-in-hand 3,000

Profit and Loss Account 1,20,000

5,04,000 5,04,000

The following assets are valued as under:

`

Machinery 1,80,000

Leasehold Properties 2,18,000

lovely professional university 195