Page 197 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 197

Accounting for Companies – II

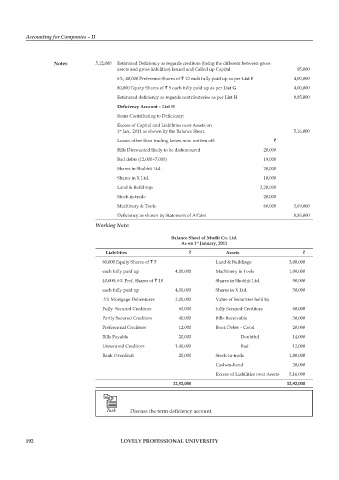

notes 5,12,000 Estimated Deficiency as regards creditors (being the different between gross

assets and gross liabilities) Issued and Called up Capital 85,000

6%; 40,000 Preference Shares of ` 10 each fully paid up as per list f 4,00,000

80,000 Equity Shares of ` 5 each fully paid up as per list g 4,00,000

Estimated deficiency as regards contributories as per list H 8,85,000

Deficiency Account – List H

Items Contributing to Deficiency:

Excess of Capital and Liabilities over Assets on

1 Jan., 2011 as shown by the Balance Sheet. 5,16,000

st

Losses other than trading losses now written off: `

Bills Discounted likely to be dishonoured 20,000

Bad debts (12,000+7,000) 19,000

Shares in Shobhit Ltd. 20,000

Shares in X Ltd. 10,000

Land & Buildings 2,20,000

Stock-in-trade 20,000

Machinery & Tools 60,000 3,69,000

Deficiency as shown by Statement of Affairs 8,85,000

Working Note:

Balance sheet of mudit co. ltd.

as on 1 January, 2011

st

liabilities ` assets `

80,000 Equity Shares of ` 5 Land & Buildings 3,00,000

each fully paid up 4,00,000 Machinery & Tools 1,00,000

40,000; 6% Pref. Shares of ` 10 Shares in Shobhit Ltd. 90,000

each fully paid up 4,00,000 Shares in X Ltd. 30,000

5% Mortgage Debentures 2,00,000 Value of Securities held by

Fully Secured Creditors 60,000 fully Secured Creditors 60,000

Partly Secured Creditors 40,000 Bills Receivable 30,000

Preferential Creditors 12,000 Book Debts – Good 20,000

Bills Payable 20,000 Doubtful 14,000

Unsecured Creditors 1,40,000 Bad 12,000

Bank Overdraft 20,000 Stock-in-trade 1,00,000

Cash-in-hand 20,000

Excess of Liabilities over Assets 5,16,000

12,92,000 12,92,000

Task Discuss the term deficiency account.

192 lovely professional university