Page 259 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 259

Accounting for Companies – II

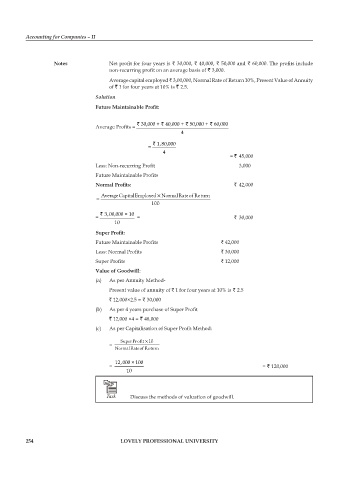

notes Net profit for four years is ` 30,000, ` 40,000, ` 50,000 and ` 60,000. The profits include

non-recurring profit on an average basis of ` 3,000.

Average capital employed ` 3,00,000, Normal Rate of Return 10%, Present Value of Annuity

of ` 1 for four years at 10% is ` 2.5.

Solution

Future Maintainable Profit:

`

`

`

Average Profits = ` 30,000 + 40,000 + 50,000 + 60,000

4

= ` 1,80,000

4

= ` 45,000

Less: Non-recurring Profit 3,000

Future Maintainable Profits

Normal Profits: ` 42,000

×

AverageCapitalEmployed NormalRateof Return

=

100

` 3,00,000 × 10

= = ` 30,000

10

Super Profit:

Future Maintainable Profits ` 42,000

Less: Normal Profits ` 30,000

Super Profits ` 12,000

value of goodwill:

(a) As per Annuity Method-

Present value of annuity of ` 1 for four years at 10% is ` 2.5

` 12,000×2.5 = ` 30,000

(b) As per 4 years purchase of Super Profit

` 12,000 ×4 = ` 48,000

(c) As per Capitalisation of Super Profit Method:

×

SuperProfit 10

=

NormalRateof Return

12,000 × 100

= = ` 120,000

10

Task Discuss the methods of valuation of goodwill.

254 lovely professional university