Page 256 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 256

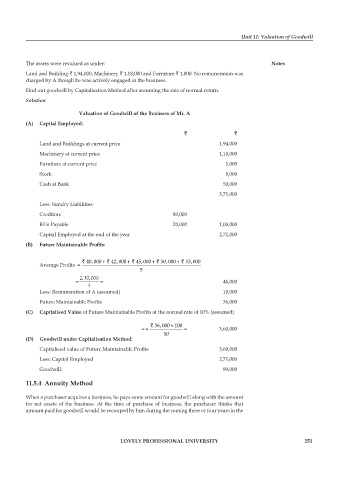

Unit 11: Valuation of Goodwill

The assets were revalued as under: notes

Land and Building ` 1,94,000, Machinery ` 1,18,000 and Furniture ` 1,000. No remuneration was

charged by A though he was actively engaged in the business.

Find out goodwill by Capitalisation Method after assuming the rate of normal return.

Solution

valuation of goodwill of the Business of mr. a

(a) capital employed:

` `

Land and Buildings at current price 1,94,000

Machinery at current price 1,18,000

Furniture at current price 1,000

Stock 8,000

Cash at Bank 50,000

3,71,000

Less: Sundry Liabilities:

Creditors 80,000

Bills Payable 20,000 1,00,000

Capital Employed at the end of the year 2,71,000

(B) Future Maintainable Profits:

40,000 + ` 42,000 + ` 45,000 + ` 50,000 + ` ` 53,000

Average Profits =

5

2,30,000

= = 46,000

5

Less: Remuneration of A (assumed) 10,000

Future Maintainable Profits 36,000

(c) capitalised value of Future Maintainable Profits at the normal rate of 10% (assumed)

` 36,000 100

×

= = = 3,60,000

10

(D) goodwill under capitalisation method:

Capitalised value of Future Maintainable Profits 3,60,000

Less: Capital Employed 2,71,000

Goodwill: 89,000

11.5.4 annuity method

When a purchaser acquires a business, he pays some amount for goodwill along with the amount

for net assets of the business. At the time of purchase of business, the purchaser thinks that

amount paid for goodwill would be recouped by him during the coming three or four years in the

lovely professional university 251