Page 253 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 253

Accounting for Companies – II

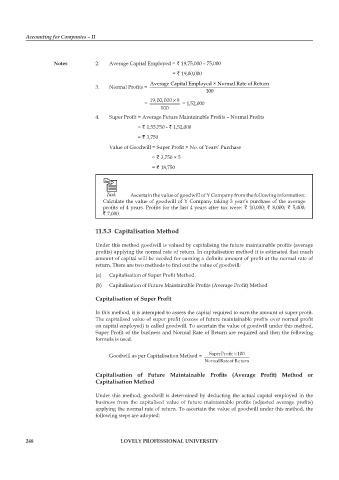

notes 2. Average Capital Employed = ` 19,75,000 – 75,000

= ` 19,00,000

Average Capital Employed × Normal Rate of Return

3. Normal Profits =

100

×

19,00,000 8

= = 1,52,000

100

4. Super Profit = Average Future Maintainable Profits – Normal Profits

= ` 1,55,750 - ` 1,52,000

= ` 3,750

Value of Goodwill = Super Profit × No. of Years’ Purchase

= ` 3,750 × 5

= ` 18,750

Task Ascertain the value of goodwill of Y Company from the following information:

Calculate the value of goodwill of Y Company taking 3 year’s purchase of the average

profits of 4 years. Profits for the last 4 years after tax were: ` 10,000; ` 8,000; ` 5,000;

` 7,000.

11.5.3 capitalisation method

Under this method goodwill is valued by capitalising the future maintainable profits (average

profits) applying the normal rate of return. In capitalisation method it is estimated that much

amount of capital will be needed for earning a definite amount of profit at the normal rate of

return. There are two methods to find out the value of goodwill:

(a) Capitalisation of Super Profit Method.

(b) Capitalisation of Future Maintainable Profits (Average Profit) Method

Capitalisation of Super Profit

In this method, it is attempted to assess the capital required to earn the amount of super profit.

The capitalised value of super profit (excess of future maintainable profits over normal profit

on capital employed) is called goodwill. To ascertain the value of goodwill under this method,

Super Profit of the business and Normal Rate of Return are required and then the following

formula is used.

×

Goodwill as per Capitalisation Method = SuperProfit 100

NormalRateof Return

Capitalisation of Future Maintainable Profits (Average profit) Method or

capitalisation method

Under this method, goodwill is determined by deducting the actual capital employed in the

business from the capitalised value of future maintainable profits (adjusted average profits)

applying the normal rate of return. To ascertain the value of goodwill under this method, the

following steps are adopted:

248 lovely professional university