Page 248 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 248

Unit 11: Valuation of Goodwill

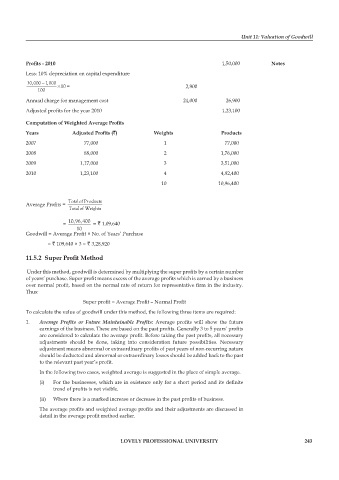

Profits - 2010 1,50,000 notes

Less: 10% depreciation on capital expenditure

−

30,000 1,000 × 10 = 2,900

100

Annual charge for management cost 24,000 26,900

Adjusted profits for the year 2010 1,23,100

Computation of Weighted Average Profits

Years Adjusted Profits (`) Weights products

2007 77,000 1 77,000

2008 88,000 2 1,76,000

2009 1,17,000 3 3,51,000

2010 1,23,100 4 4,92,400

10 10,96,400

Average Profits = Totalof Products

Totalof Weights

= 10,96,400 = ` 1,09,640

10

Goodwill = Average Profit × No. of Years’ Purchase

= ` 109,640 × 3 = ` 3,28,920

11.5.2 Super Profit Method

Under this method, goodwill is determined by multiplying the super profits by a certain number

of years’ purchase. Super profit means excess of the average profits which is earned by a business

over normal profit, based on the normal rate of return for representative firm in the industry.

Thus:

Super profit = Average Profit – Normal Profit

To calculate the value of goodwill under this method, the following three items are required:

1. Average Profits or Future Maintainable Profits: Average profits will show the future

earnings of the business. These are based on the past profits. Generally 3 to 5 years’ profits

are considered to calculate the average profit. Before taking the past profits, all necessary

adjustments should be done, taking into consideration future possibilities. Necessary

adjustment means abnormal or extraordinary profits of past years of non-recurring nature

should be deducted and abnormal or extraordinary losses should be added back to the past

to the relevant past year’s profit.

In the following two cases, weighted average is suggested in the place of simple average.

(i) For the businesses, which are in existence only for a short period and its definite

trend of profits is not visible.

(ii) Where there is a marked increase or decrease in the past profits of business.

The average profits and weighted average profits and their adjustments are discussed in

detail in the average profit method earlier.

lovely professional university 243