Page 247 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 247

Accounting for Companies – II

notes

2

Y’s share is goodwill = 4,26,000 ×

5

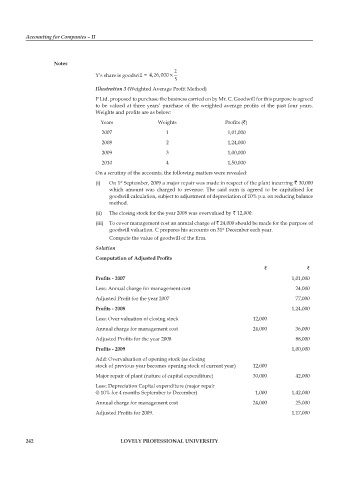

Illustration 3 (Weighted Average Profit Method)

P Ltd. proposed to purchase the business carried on by Mr. C. Goodwill for this purpose is agreed

to be valued at three years’ purchase of the weighted average profits of the past four years.

Weights and profits are as below:

Years Weights Profits (`)

2007 1 1,01,000

2008 2 1,24,000

2009 3 1,00,000

2010 4 1,50,000

On a scrutiny of the accounts, the following matters were revealed:

(i) On 1 September, 2009 a major repair was made in respect of the plant incurring ` 30,000

st

which amount was charged to revenue. The said sum is agreed to be capitalised for

goodwill calculation, subject to adjustment of depreciation of 10% p.a. on reducing balance

method.

(ii) The closing stock for the year 2008 was overvalued by ` 12,000.

(iii) To cover management cost an annual charge of ` 24,000 should be made for the purpose of

goodwill valuation. C prepares his accounts on 31 December each year.

st

Compute the value of goodwill of the firm.

Solution

Computation of Adjusted Profits

` `

Profits - 2007 1,01,000

Less: Annual charge for management cost 24,000

Adjusted Profit for the year 2007 77,000

Profits - 2008 1,24,000

Less: Over valuation of closing stock 12,000

Annual charge for management cost 24,000 36,000

Adjusted Profits for the year 2008 88,000

Profits - 2009 1,00,000

Add: Overvaluation of opening stock (as closing

stock of previous year becomes opening stock of current year) 12,000

Major repair of plant (nature of capital expenditure) 30,000 42,000

Less: Depreciation Capital expenditure (major repair

@ 10% for 4 months September to December) 1,000 1,42,000

Annual charge for management cost 24,000 25,000

Adjusted Profits for 2009. 1,17,000

242 lovely professional university