Page 249 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 249

Accounting for Companies – II

notes 2. Normal Rate of Return or Profit: Normal rate of return or profit is that rate which investors

in general expect on their investments in a particular type of industry. In other words, that

rate of earning which satisfies the investors is the normal rate of return. This normal rate of

return differs from industry to industry. In examination problems, generally normal rate

of return is given. In an extreme case, the normal rate of return or earning is not mentioned

the student should assume the normal rate of return basing his judgment on merits of the

case. At the time of assuming the normal rate of return the students should keep in mind

the following points:

(a) Pure rate of return: That rate of return which one can earn by investing his funds

without incurring any risk e.g., purchasing government securities.

(b) Rate of business risk: If more risk is attached to an investment, there will be high rate

of return. Risk depends on the nature of the business.

(c) Rate of financial risk: That rate which covers risks connected with the finance of a

business concerned.

(d) Rate of return: The addition of the above three will be normal rate of return.

The normal rate of return of an industry is also affected by the bank rate, the period for

which investment is made, risk attached to the investment and the general economic and

political situations.

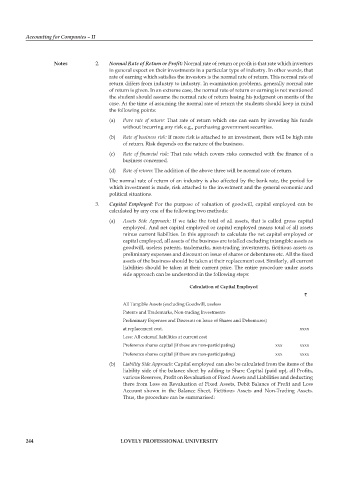

3. Capital Employed: For the purpose of valuation of goodwill, capital employed can be

calculated by any one of the following two methods:

(a) Assets Side Approach: If we take the total of all assets, that is called gross capital

employed. And net capital employed or capital employed means total of all assets

minus current liabilities. In this approach to calculate the net capital employed or

capital employed, all assets of the business are totalled excluding intangible assets as

goodwill, useless patents, trademarks, non-trading investments, fictitious assets as

preliminary expenses and discount on issue of shares or debentures etc. All the fixed

assets of the business should be taken at their replacement cost. Similarly, all current

liabilities should be taken at their current price. The entire procedure under assets

side approach can be understood in the following steps:

calculation of capital employed

`

All Tangible Assets (excluding Goodwill, useless

Patents and Trademarks, Non-trading Investments

Preliminary Expenses and Discount on Issue of Shares and Debentures)

at replacement cost. xxxx

Less: All external liabilities at current cost

Preference shares capital (if these are non-participating) xxx xxxx

Preference shares capital (if these are non-participating) xxx xxxx

(b) Liability Side Approach: Capital employed can also be calculated from the items of the

liability side of the balance sheet by adding to Share Capital (paid up), all Profits,

various Reserves, Profit on Revaluation of Fixed Assets and Liabilities and deducting

there from Loss on Revaluation of Fixed Assets, Debit Balance of Profit and Loss

Account shown in the Balance Sheet, Fictitious Assets and Non-Trading Assets.

Thus, the procedure can be summarised:

244 lovely professional university