Page 250 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 250

Unit 11: Valuation of Goodwill

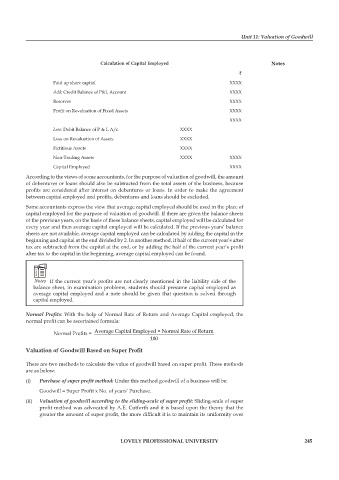

calculation of capital employed notes

`

Paid up share capital XXXX

Add: Credit Balance of P&L Account XXXX

Reserves XXXX

Profit on Revaluation of Fixed Assets XXXX

XXXX

Less: Debit Balance of P & L A/c XXXX

Loss on Revaluation of Assets XXXX

Fictitious Assets XXXX

Non-Trading Assets XXXX XXXX

Capital Employed XXXX

According to the views of some accountants, for the purpose of valuation of goodwill, the amount

of debentures or loans should also be subtracted from the total assets of the business, because

profits are considered after interest on debentures or loans. In order to make the agreement

between capital employed and profits, debentures and loans should be excluded.

Some accountants express the view that average capital employed should be used in the place of

capital employed for the purpose of valuation of goodwill. If there are given the balance sheets

of the previous years, on the basis of these balance sheets, capital employed will be calculated for

every year and then average capital employed will be calculated. If the previous years’ balance

sheets are not available, average capital employed can be calculated by adding the capital in the

beginning and capital at the end divided by 2. In another method, if half of the current year’s after

tax are subtracted from the capital at the end, or by adding the half of the current year’s profit

after tax to the capital in the beginning, average capital employed can be found.

Notes If the current year’s profits are not clearly mentioned in the liability side of the

balance sheet, in examination problems, students should presume capital employed as

average capital employed and a note should be given that question is solved through

capital employed.

Normal Profits: With the help of Normal Rate of Return and Average Capital employed, the

normal profit can be ascertained formula:

Normal Profits = Average Capital Employed × Normal Rate of Return

100

Valuation of Goodwill Based on Super Profit

There are two methods to calculate the value of goodwill based on super profit. These methods

are as below:

(i) Purchase of super profit method: Under this method goodwill of a business will be:

Goodwill = Super Profit x No. of years’ Purchase.

(ii) Valuation of goodwill according to the sliding-scale of super profit: Sliding-scale of super

profit method was advocated by A.E. Cutforth and it is based upon the theory that the

greater the amount of super profit, the more difficult it is to maintain its uniformity over

lovely professional university 245