Page 251 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 251

Accounting for Companies – II

notes a long period. The logic behind this is that high super profit would attract more traders

and thus it will shorten the period during which this high super profit would be earned.

Therefore, Cutforth split the super profit into two or three slabs according to the nature

of the business. Each of these slabs is multiplied by a different number of years’ purchase

in descending order from the first slab. Thus, total of the purchase of such slabs gives the

value of the goodwill. This method should be applied only in those cases where super

profits are enormously high. Such super profits cannot be obtained on a continuous basis

in the future.

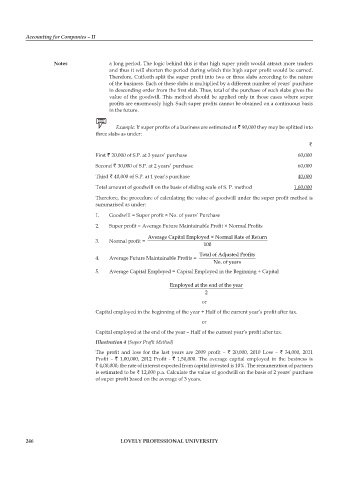

Example: If super profits of a business are estimated at ` 90,000 they may be splitted into

three slabs as under:

`

First ` 20,000 of S.P. at 3 years’ purchase 60,000

Second ` 30,000 of S.P. at 2 years’ purchase 60,000

Third ` 40,000 of S.P. at 1 year’s purchase 40,000

Total amount of goodwill on the basis of sliding scale of S. P. method 1,60,000

Therefore, the procedure of calculating the value of goodwill under the super profit method is

summarised as under:

1. Goodwill = Super profit × No. of years’ Purchase

2. Super profit = Average Future Maintainable Profit × Normal Profits

Average Capital Employed × Normal Rate of Return

3. Normal profit =

100

Total of Adjusted Profits

4. Average Future Maintainable Profits =

No. of years

5. Average Capital Employed = Capital Employed in the Beginning + Capital

Employed at the end of the year

2

or

Capital employed in the beginning of the year + Half of the current year’s profit after tax.

or

Capital employed at the end of the year – Half of the current year’s profit after tax.

Illustration 4 (Super Profit Method)

The profit and loss for the last years are 2009 profit – ` 20,000, 2010 Loss – ` 34,000, 2011

Profit – ` 1,00,000, 2012 Profit - ` 1,50,000. The average capital employed in the business is

` 4,00,000; the rate of interest expected from capital invested is 10%. The remuneration of partners

is estimated to be ` 12,000 p.a. Calculate the value of goodwill on the basis of 2 years’ purchase

of super profit based on the average of 3 years.

246 lovely professional university