Page 272 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 272

Unit 12: Valuation of Shares

If the arrears of preference dividend are shown in the liability side of the balance sheet that Notes

is always subtracted from the net assets of the company and then value of each share is

calculated.

(iv) When preference shares have no priority for payment of capital and dividend: It means

preference shares and equity shares are of the same rank. If the paid up value of both type

of the shares is the same, total net assets will be divided by the total number of equity

and preferences shares to compute the value of each share. Here the value of equity and

preference share will be same. If the paid up value of equity and preferences shares is not

equal, first the total net assets of the company will be divided in the ratio of paid up capital

of equity shares and preference shares. To ascertain the value of each share, each portion of

the net assets will be divided by their respective number of shares.

(v) When preferences shares are participating: In this case, the entire net assets will be divided

into the equity shares and preference shares as per the rights given in the Articles of

Association of the company. Then, each portion of the net assets will be divided by its

respective number of shares in order to compute the value of share.

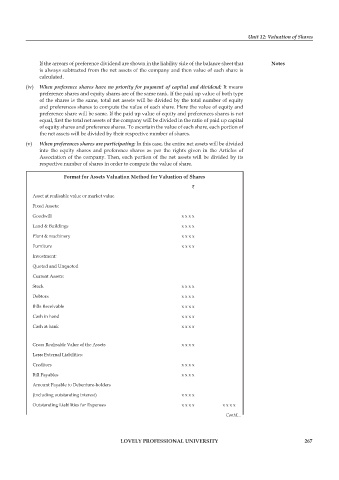

Format for Assets Valuation Method for Valuation of Shares

`

Asset at realisable value or market value

Fixed Assets:

Goodwill x x x x

Land & Buildings x x x x

Plant & machinery x x x x

Furniture x x x x

Investment:

Quoted and Unquoted

Current Assets:

Stock x x x x

Debtors x x x x

Bills Receivable x x x x

Cash in hand x x x x

Cash at bank x x x x

Gross Realisable Value of the Assets x x x x

Less: External Liabilities:

Creditors x x x x

Bill Payables x x x x

Amount Payable to Debenture-holders

(including outstanding interest) x x x x

Outstanding Liabilities for Expenses x x x x x x x x

Contd...

LOVELY PROFESSIONAL UNIVERSITY 267