Page 275 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 275

Accounting for Companies – II

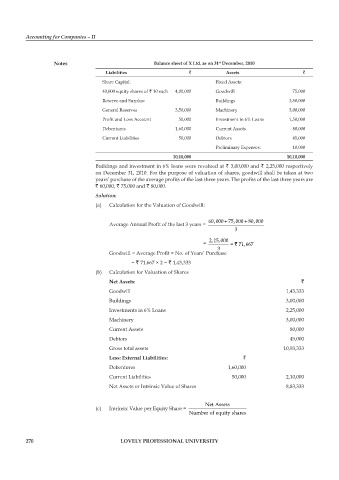

Notes Balance sheet of X Ltd. as on 31 December, 2010

st

Liabilities ` Assets `

Share Capital: Fixed Assets:

40,000 equity shares of ` 10 each 4,00,000 Goodwill 75,000

Reserve and Surplus: Buildings 3,50,000

General Reserves 3,50,000 Machinery 3,00,000

Profit and Loss Account 50,000 Investment in 6% Loans 1,50,000

Debentures 1,60,000 Current Assets 80,000

Current Liabilities 50,000 Debtors 45,000

Preliminary Expenses: 10,000

10,10,000 10,10,000

Buildings and investment in 6% loans were revalued at ` 3,00,000 and ` 2,25,000 respectively

on December 31, 2010. For the purpose of valuation of shares, goodwill shall be taken at two

years’ purchase of the average profits of the last three years. The profits of the last three years are

` 60,000, ` 75,000 and ` 80,000.

Solution:

(a) Calculation for the Valuation of Goodwill:

+

60,000 75,000 80,000

+

Average Annual Profit of the last 3 years =

3

2,15,000

= = ` 71,667

3

Goodwill = Average Profit × No. of Years’ Purchase

= ` 71,667 × 2 = ` 1,43,333

(b) Calculation for Valuation of Shares

Net Assets: `

Goodwill 1,43,333

Buildings 3,00,000

Investments in 6% Loans 2,25,000

Machinery 3,00,000

Current Assets 80,000

Debtors 45,000

Gross total assets 10,93,333

Less: External Liabilities: `

Debentures 1,60,000

Current Liabilities 50,000 2,10,000

Net Assets or Intrinsic Value of Shares 8,83,333

Net Assets

(c) Intrinsic Value per Equity Share =

Number of equity shares

270 LOVELY PROFESSIONAL UNIVERSITY