Page 276 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 276

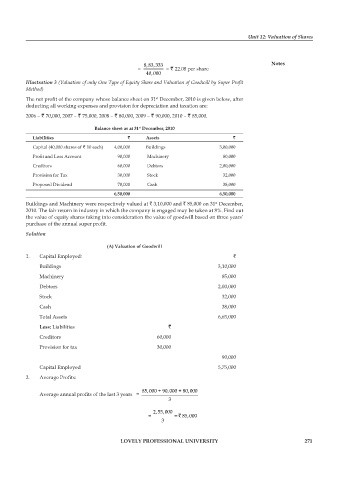

Unit 12: Valuation of Shares

8,83,333 Notes

= = ` 22.08 per share

40,000

Illustration 3 (valuation of only one Type of Equity Share and valuation of goodwill by Super Profit

Method)

The net profit of the company whose balance sheet on 31 December, 2010 is given below, after

st

deducting all working expenses and provision for depreciation and taxation are:

2006 – ` 70,000, 2007 – ` 75,000, 2008 – ` 80,000, 2009 – ` 90,000, 2010 – ` 85,000.

Balance sheet as at 31 December, 2010

st

Liabilities ` Assets `

Capital (40,000 shares of ` 10 each) 4,00,000 Buildings 3,00,000

Profit and Loss Account 90,000 Machinery 80,000

Creditors 60,000 Debtors 2,00,000

Provision for Tax 30,000 Stock 32,000

Proposed Dividend 70,000 Cash 38,000

6,50,000 6,50,000

Buildings and Machinery were respectively valued at ` 3,10,000 and ` 85,000 on 31 December,

st

2010. The fair return in industry in which the company is engaged may be taken at 8%. Find out

the value of equity shares taking into consideration the value of goodwill based on three years’

purchase of the annual super profit.

Solution

(A) Valuation of goodwill

1. Capital Employed: `

Buildings 3,10,000

Machinery 85,000

Debtors 2,00,000

Stock 32,000

Cash 38,000

Total Assets 6,65,000

Less: Liabilities `

Creditors 60,000

Provision for tax 30,000

90,000

Capital Employed 5,75,000

2. Average Profits:

85,000 + 90,000 + 80,000

Average annual profits of the last 3 years =

3

2,55,000

= = 85,000

`

3

LOVELY PROFESSIONAL UNIVERSITY 271