Page 278 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 278

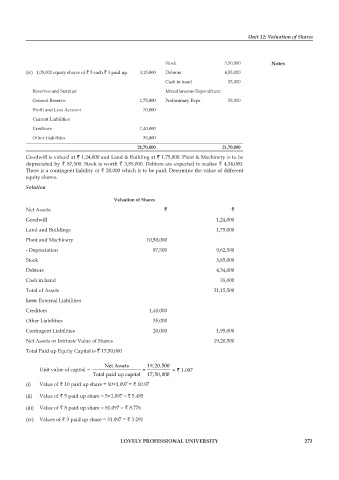

Unit 12: Valuation of Shares

Stock 3,50,000 Notes

(iv) 1,05,000 equity shares of ` 5 each ` 3 paid up. 3,15,000 Debtors 4,55,000

Cash in hand 35,000

Reserves and Surplus: Miscellaneous Expenditure:

General Reserve 1,75,000 Preliminary Exps. 35,000

Profit and Loss Account 70,000

Current Liabilities:

Creditors 1,40,000

Other Liabilities 35,000

21,70,000 21,70,000

Goodwill is valued at ` 1,24,000 and Land & Building at ` 1,75,000. Plant & Machinery is to be

depreciated by ` 87,500. Stock is worth ` 3,85,000. Debtors are expected to realise ` 4,34,000.

There is a contingent liability of ` 20,000 which is to be paid. Determine the value of different

equity shares.

Solution

Valuation of Shares

Net Assets: ` `

Goodwill 1,24,000

Land and Buildings 1,75,000

Plant and Machinery 10,50,000

- Depreciation 87,500 9,62,500

Stock 3,85,000

Debtors 4,34,000

Cash in hand 35,000

Total of Assets 21,15,500

Less: External Liabilities

Creditors 1,40,000

Other Liabilities 35,000

Contingent Liabilities 20,000 1,95,000

Net Assets or Intrinsic Value of Shares 19,20,500

Total Paid up Equity Capital is ` 17,50,000

Net Assets 19,20,500

Unit value of capital = = = ` 1.097

Total paid up capital 17,50,000

(i) Value of ` 10 paid up share = 10×1.097 = ` 10.97

(ii) Value of ` 5 paid up share = 5×1.097 = ` 5.485

(iii) Value of ` 8 paid up share = 81.097 = ` 8.776

(iv) Values of ` 3 paid up share = 31.097 = ` 3.291

LOVELY PROFESSIONAL UNIVERSITY 273