Page 293 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 293

Accounting for Companies – II

Notes (c) Valuation of Bonus Shares

(d) Normal Rate of Return.

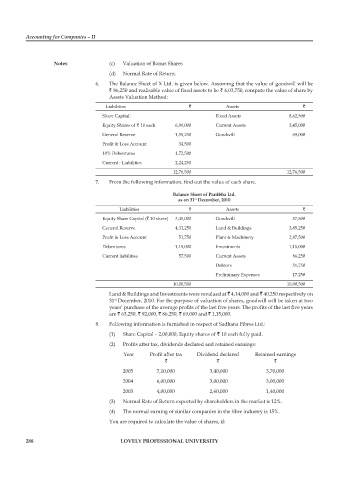

6. The Balance Sheet of X Ltd. is given below. Assuming that the value of goodwill will be

` 86,250 and realisable value of fixed assets to be ` 6,03,750, compute the value of share by

Assets Valuation Method:

Liabilities ` Assets `

Share Capital: Fixed Assets 8,62,500

Equity Shares of ` 10 each 6,90,000 Current Assets 3,45,000

General Reserve 1,55,250 Goodwill 69,000

Profit & Loss Account 34,500

10% Debentures 1,72,500

Current : Liabilities 2,24,250

12,76,500 12,76,500

7. From the following information, find out the value of each share.

Balance Sheet of Pratibha Ltd.

as on 31 December, 2010

st

Liabilities ` Assets `

Equity Share Capital (` 10 share) 3,45,000 Goodwill 57,500

General Reserve 4,31,250 Land & Buildings 3,85,250

Profit & Loss Account 51,750 Plant & Machinery 2,87,500

Debentures 1,15,000 Investments 1,15,000

Current liabilities 57,500 Current Assets 86,250

Debtors 51,750

Preliminary Expenses 17,250

10,00,500 10,00,500

Land & Buildings and Investments were revalued at ` 4,14,000 and ` 40,250 respectively on

31 December, 2010. For the purpose of valuation of shares, goodwill will be taken at two

st

years’ purchase of the average profits of the last five years. The profits of the last five years

are ` 63,250, ` 92,000, ` 86,250, ` 69,000 and ` 1,15,000.

8. Following information is furnished in respect of Sadhana Fibres Ltd.:

(1) Share Capital – 2,00,000, Equity shares of ` 10 each fully paid.

(2) Profits after tax, dividends declared and retained earnings:

Year Profit after tax Dividend declared Retained earnings

` ` `

2005 7,10,000 3,40,000 3,70,000

2004 6,00,000 3,00,000 3,00,000

2003 4,00,000 2,60,000 1,40,000

(3) Normal Rate of Return expected by shareholders in the market is 12%.

(4) The normal earning of similar companies in the fibre industry is 15%.

You are required to calculate the value of shares, if:

288 LOVELY PROFESSIONAL UNIVERSITY