Page 289 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 289

Accounting for Companies – II

Notes value of the share. It is considered the most appropriate method. For this method, the following

formula is used–

+

Fair Value of the Share = Intrinsic Valueof theShare Marketor Yield Valueof theShare

2

To find out the intrinsic value of the share and market or yield value of the share, the Net Assets

Valuation Method and Earning Basis Valuation Method are applied respectively. These methods

have been elaborated earlier.

Notes Fair Value Method is also known as Dual Method.

Illustration 11 (Fair value of the Shares)

From the information given below and the Balance Sheet of A Ltd. on 31 December, 2010, find

st

out the value of its equity shares by the Dual Method (appropriate basis):

(a) Company’s prospects for 2011 are good.

(b) Buildings are now worth ` 7,00,000.

(c) Profits for the last three years have shown an annual increase of ` 50,000. The annual

transfer to reserve is 25% of the net profit.

(d) Preferential shares are preferential as to capital and dividend and;

(e) Normal rate of return expected is 15%.

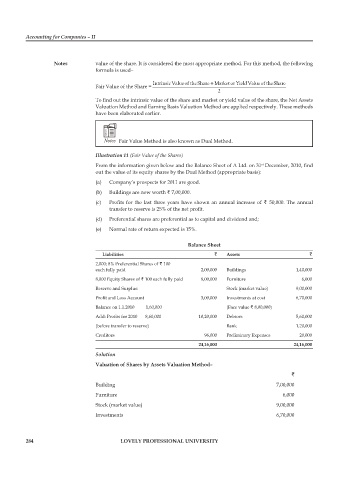

Balance Sheet

Liabilities ` Assets `

2,000; 8% Preferential Shares of ` 100

each fully paid 2,00,000 Buildings 1,40,000

8,000 Equity Shares of ` 100 each fully paid 8,00,000 Furniture 6,000

Reserve and Surplus: Stock (market value) 9,00,000

Profit and Loss Account 3,00,000 Investments at cost 6,70,000

Balance on 1.1.2010 1,60,000 (Face value ` 8,00,000)

Add: Profits for 2010 8,60,000 10,20,000 Debtors 5,60,000

(before transfer to reserve) Bank 1,20,000

Creditors 96,000 Preliminary Expenses 20,000

24,16,000 24,16,000

Solution

Valuation of Shares by Assets Valuation Method–

`

Building 7,00,000

Furniture 6,000

Stock (market value) 9,00,000

Investments 6,70,000

284 LOVELY PROFESSIONAL UNIVERSITY