Page 286 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 286

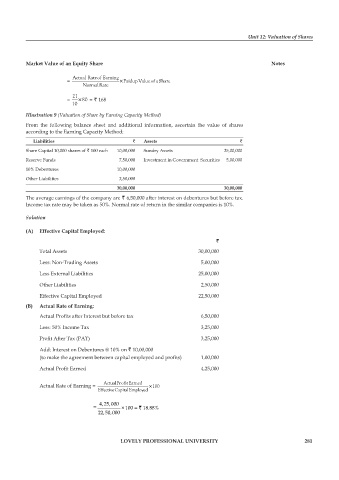

Unit 12: Valuation of Shares

Market Value of an Equity Share Notes

Actual Rateof Earning

= ×PaidupValueof aShare

NormalRate

21

= ×80 = ` 168

10

Illustration 9 (valuation of Share by Earning Capacity Method)

From the following balance sheet and additional information, ascertain the value of shares

according to the Earning Capacity Method:

Liabilities ` Assets `

Share Capital 10,000 shares of ` 100 each 10,00,000 Sundry Assets 25,00,000

Reserve Funds 7,50,000 Investment in Government Securities 5,00,000

10% Debentures 10,00,000

Other Liabilities 2,50,000

30,00,000 30,00,000

The average earnings of the company are ` 6,50,000 after interest on debentures but before tax.

Income tax rate may be taken as 50%. Normal rate of return in the similar companies is 10%.

Solution

(A) Effective Capital Employed:

`

Total Assets 30,00,000

Less: Non-Trading Assets 5,00,000

Less External Liabilities 25,00,000

Other Liabilities 2,50,000

Effective Capital Employed 22,50,000

(B) Actual Rate of Earning:

Actual Profits after Interest but before tax 6,50,000

Less: 50% Income Tax 3,25,000

Profit After Tax (PAT) 3,25,000

Add: Interest on Debentures @ 10% on ` 10,00,000

(to make the agreement between capital employed and profits) 1,00,000

Actual Profit Earned 4,25,000

Actual Rate of Earning = ActualProfit Earned × 100

EffectiveCapitalEmployed

4,25,000

= × 100 = ` 18.88%

22,50,000

LOVELY PROFESSIONAL UNIVERSITY 281