Page 288 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 288

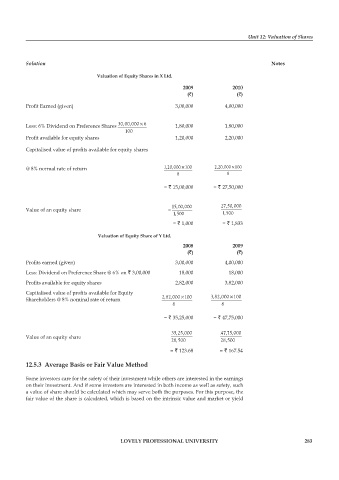

Unit 12: Valuation of Shares

Solution Notes

Valuation of Equity Shares in X Ltd.

2009 2010

(`) (`)

Profit Earned (given) 3,00,000 4,00,000

Rs.30,00,000 6

Less: 6% Dividend on Preference Shares × 1,80,000 1,80,000

100

Profit available for equity shares 1,20,000 2,20,000

Capitalised value of profits available for equity shares

×

×

@ 8% normal rate of return 1,20,000 100 2,20,000 100

8 8

= ` 15,00,000 = ` 27,50,000

Rs.15,00,000 Rs.27,50,000

Value of an equity share =

1,500 1,500

= ` 1,000 = ` 1,833

Valuation of Equity Share of Y Ltd.

2008 2009

(`) (`)

Profits earned (given) 3,00,000 4,00,000

Less: Dividend on Preference Share @ 6% on ` 3,00,000 18,000 18,000

Profits available for equity shares 2,82,000 3,82,000

Capitalised value of profits available for Equity

×

×

Shareholders @ 8% nominal rate of return Rs.2,82,000 100 Rs.3,82,000 100

8 8

= ` 35,25,000 = ` 47,75,000

Rs.35,25,000 Rs.47,75,000

Value of an equity share

28,500 28,500

= ` 123.68 = ` 167.54

12.5.3 Average Basis or Fair Value Method

Some investors care for the safety of their investment while others are interested in the earnings

on their investment. And if some investors are interested in both income as well as safety, such

a value of share should be calculated which may serve both the purposes. For this purpose, the

fair value of the share is calculated, which is based on the intrinsic value and market or yield

LOVELY PROFESSIONAL UNIVERSITY 283