Page 22 - DCOM206_COST_ACCOUNTING_II

P. 22

Unit 1: Service Costing

Administrative overheads ` 10,000 Notes

Hire for print ` 1,00,000

Other expenses ` 5,000

The premises are valued at ` 6,00,000 and its estimated life is 10 years. Projector and other

equipments cost ` 2,00,000 on which 10% depreciation is to be charged. Daily three shows are

run throughout the year. Total capacity is 500 seats which are divided into three classes as

follows:

Third class 250 seats

Second class 150 seats

First class 100 seats

Ascertain cost per man show assuming that:

(a) 20% of the total seats remain vacant, and

(b) Weightage to be given to these classes in to the ration of 1:2:3

Determined the rate for each class if the management expects 33.33 % return on gross proceeds.

Ignore entertainment taxes.

Solution:

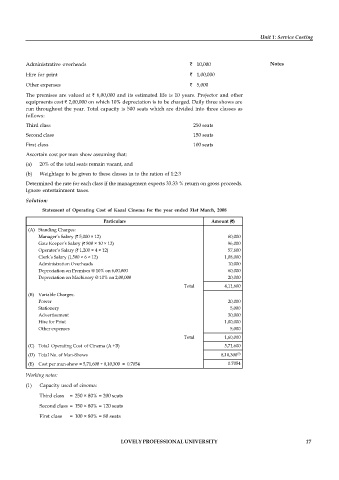

Statement of Operating Cost of Kazal Cinema for the year ended 31st March, 2008

Particulars Amount (`)

(A) Standing Charges:

Manager’s Salary (` 5,000 × 12) 60,000

Gate Keeper’s Salary (` 800 × 10 × 12) 96,000

Operator’s Salary (` 1,200 × 4 × 12) 57,600

Clerk’s Salary (1,500 × 6 × 12) 1,08,000

Administration Overheads 10,000

Depreciation on Premises @ 10% on 6,00,000 60,000

Depreciation on Machinery @ 10% on 2,00,000 20,000

Total 4,11,600

(B) Variable Charges:

Power 20,000

Stationery 5,000

Advertisement 30,000

Hire for Print 1,00,000

Other expenses 5,000

Total 1,60,000

(C) Total Operating Cost of Cinema (A +B) 5,71,600

(3)

(D) Total No. of Man-Shows 8,10,300

(E) Cost per man-show = 5,71,600 ÷ 8,10,300 = 0.7054 0.7054

Working notes:

(1) Capacity used of cinema:

Third class = 250 × 80% = 200 seats

Second class = 150 × 80% = 120 seats

First class = 100 × 80% = 80 seats

LOVELY PROFESSIONAL UNIVERSITY 17