Page 237 - DCOM206_COST_ACCOUNTING_II

P. 237

Cost Accounting – II

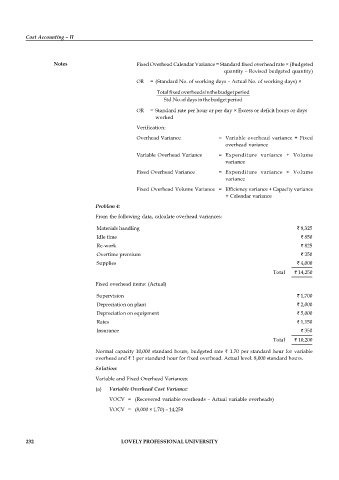

Notes Fixed Overhead Calendar Variance = Standard fixed overhead rate × (Budgeted

quantity – Revised budgeted quantity)

OR = (Standard No. of working days – Actual No. of working days) ×

Totalfixedoverheadsinthebudgetperiod

Std.No.ofdaysinthebudgetperiod

OR = Standard rate per hour or per day × Excess or deficit hours or days

worked

Verification:

Overhead Variance = Variable overhead variance + Fixed

overhead variance

Variable Overhead Variance = Expenditure variance + Volume

variance

Fixed Overhead Variance = Expenditure variance + Volume

variance

Fixed Overhead Volume Variance = Efficiency variance + Capacity variance

+ Calendar variance

Problem 4:

From the following data, calculate overhead variances:

Materials handling ` 8,325

Idle time ` 850

Re-work ` 825

Overtime premium ` 250

Supplies ` 4,000

Total ` 14,250

Fixed overhead items: (Actual)

Supervision ` 1,700

Depreciation on plant ` 2,000

Depreciation on equipment ` 5,000

Rates ` 1,150

Insurance ` 350

Total ` 10,200

Normal capacity 10,000 standard hours, budgeted rate ` 1.70 per standard hour for variable

overhead and ` 1 per standard hour for fixed overhead. Actual level: 8,000 standard hours.

Solution:

Variable and Fixed Overhead Variances:

(a) Variable Overhead Cost Variance:

VOCV = (Recovered variable overheads – Actual variable overheads)

VOCV = (8,000 × 1.70) – 14,250

232 LOVELY PROFESSIONAL UNIVERSITY