Page 236 - DCOM206_COST_ACCOUNTING_II

P. 236

Unit 12: Standard Costing

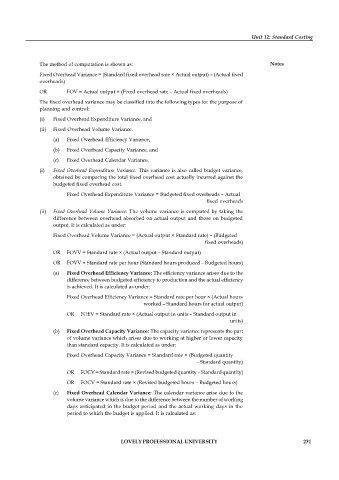

The method of computation is shown as: Notes

Fixed Overhead Variance = (Standard fixed overhead rate × Actual output) – (Actual fixed

overheads)

OR FOV = Actual output × (Fixed overhead rate – Actual fixed overheads)

The fixed overhead variance may be classified into the following types for the purpose of

planning and control:

(i) Fixed Overhead Expenditure Variance, and

(ii) Fixed Overhead Volume Variance.

(a) Fixed Overhead Efficiency Variance,

(b) Fixed Overhead Capacity Variance, and

(c) Fixed Overhead Calendar Variance.

(i) Fixed Overhead Expenditure Variance: This variance is also called budget variance,

obtained by comparing the total fixed overhead cost actually incurred against the

budgeted fixed overhead cost.

Fixed Overhead Expenditure Variance = Budgeted fixed overheads – Actual

fixed overheads

(ii) Fixed Overhead Volume Variance: The volume variance is computed by taking the

difference between overhead absorbed on actual output and those on budgeted

output. It is calculated as under:

Fixed Overhead Volume Variance = (Actual output × Standard rate) – (Budgeted

fixed overheads)

OR FOVV = Standard rate × (Actual output – Standard output)

OR FOVV = Standard rate per hour (Standard hours produced – Budgeted hours)

(a) Fixed Overhead Efficiency Variance: The efficiency variance arises due to the

difference between budgeted efficiency to production and the actual efficiency

is achieved. It is calculated as under:

Fixed Overhead Efficiency Variance = Standard rate per hour × (Actual hours

worked – Standard hours for actual output)

OR FOEV = Standard rate × (Actual output in units – Standard output in

units)

(b) Fixed Overhead Capacity Variance: The capacity variance represents the part

of volume variance which arises due to working at higher or lower capacity

than standard capacity. It is calculated as under:

Fixed Overhead Capacity Variance = Standard rate × (Budgeted quantity

– Standard quantity)

OR FOCV = Standard rate × (Revised budgeted quantity – Standard quantity)

OR FOCV = Standard rate × (Revised budgeted hours – Budgeted hours)

(c) Fixed Overhead Calendar Variance: The calendar variance arise due to the

volume variance which is due to the difference between the number of working

days anticipated in the budget period and the actual working days in the

period to which the budget is applied. It is calculated as:

LOVELY PROFESSIONAL UNIVERSITY 231