Page 235 - DCOM206_COST_ACCOUNTING_II

P. 235

Cost Accounting – II

Notes

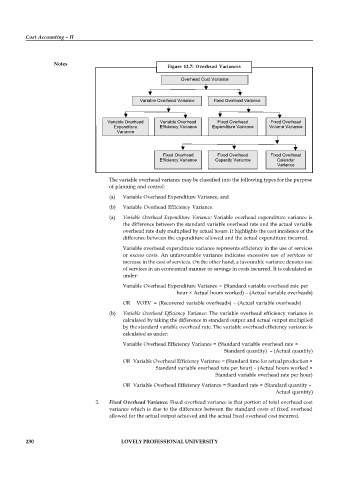

Figure 12.7: Overhead Variances

Overhead Cost Variance

Variable Overhead Variance Fixed Overhead Variance

Variable Overhead Variable Overhead Fixed Overhead Fixed Overhead

Expenditure Efficiency Variance Expenditure Variance Volume Variance

Variance

Fixed Overhead Fixed Overhead Fixed Overhead

Efficiency Variance Capacity Variance Calendar

Variance

The variable overhead variance may be classified into the following types for the purpose

of planning and control:

(a) Variable Overhead Expenditure Variance, and

(b) Variable Overhead Efficiency Variance.

(a) Variable Overhead Expenditure Variance: Variable overhead expenditure variance is

the difference between the standard variable overhead rate and the actual variable

overhead rate duly multiplied by actual hours. It highlights the cost incidence of the

difference between the expenditure allowed and the actual expenditure incurred.

Variable overhead expenditure variance represents efficiency in the use of services

or excess costs. An unfavourable variance indicates excessive use of services or

increase in the cost of services. On the other hand, a favourable variance denotes use

of services in an economical manner or savings in costs incurred. It is calculated as

under:

Variable Overhead Expenditure Variance = (Standard variable overhead rate per

hour × Actual hours worked) – (Actual variable overheads)

OR VOEV = (Recovered variable overheads) – (Actual variable overheads)

(b) Variable Overhead Efficiency Variance: The variable overhead efficiency variance is

calculated by taking the difference in standard output and actual output multiplied

by the standard variable overhead rate. The variable overhead efficiency variance is

calculated as under:

Variable Overhead Efficiency Variance = (Standard variable overhead rate ×

Standard quantity) – (Actual quantity)

OR Variable Overhead Efficiency Variance = (Standard time for actual production ×

Standard variable overhead rate per hour) – (Actual hours worked ×

Standard variable overhead rate per hour)

OR Variable Overhead Efficiency Variance = Standard rate × (Standard quantity –

Actual quantity)

2. Fixed Overhead Variance: Fixed overhead variance is that portion of total overhead cost

variance which is due to the difference between the standard costs of fixed overhead

allowed for the actual output achieved and the actual fixed overhead cost incurred.

230 LOVELY PROFESSIONAL UNIVERSITY