Page 55 - DCOM206_COST_ACCOUNTING_II

P. 55

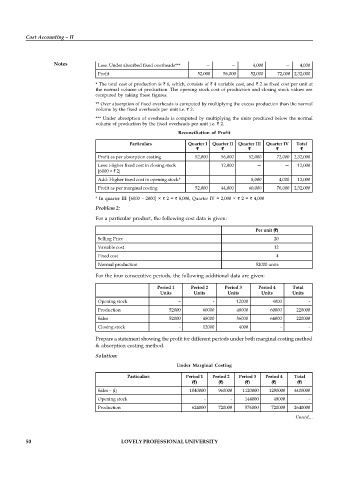

Particulars

`

`

`

`

`

[A] Sales @ ` 8

2,08,000

2,24,000

2,56,000 8,80,000

1,92,000

—

36,000

[B] Opening Stock @ ` 6 Quarter I Quarter II Quarter III Quarter IV Total

—

12,000

[C] Cost of Production@ ` 6* 1,56,000 1,80,000 1,44,000 1,80,000 6,60,000

[D] A + C 1,56,000 1,80,000 1,80,000 1,92,000 6,60,000

[E] Closing Stock@ ` 6 — 36,000 12,000 — —

[F] Cost of Sales [Actual] D – E 1,56,000 1,44,000 1,68,000 1,92,000 6,60,000

Cost Accounting – II

[G] Profit before adjustment of under or 52,000 48,000 56,000 64,000 2,20,000

over absorbed fixed cost [A – F]

Add: Over absorbed fixed overheads** — 8,000 — 8,000 16,000

Notes Less: Under absorbed fixed overheads*** — — 4,000 — 4,000

Profit 52,000 56,000 52,000 72,000 2,32,000

* The total cost of production is ` 6, which, consists of ` 4 variable cost, and ` 2 as fixed cost per unit at

the normal volume of production. The opening stock cost of production and closing stock values are

computed by taking these figures.

** Over absorption of fixed overheads is computed by multiplying the excess production than the normal

volume by the fixed overheads per unit i.e. ` 2.

*** Under absorption of overheads is computed by multiplying the units produced below the normal

volume of production by the fixed overheads per unit i.e. ` 2.

Reconciliation of Profit

Particulars Quarter I Quarter II Quarter III Quarter IV Total

` ` ` ` `

Profit as per absorption costing 52,000 56,000 52,000 72,000 2,32,000

Less: Higher fixed cost in closing stock 12,000 — — 12,000

[6000 × ` 2]

Add: Higher fixed cost in opening stock* 8,000 4,000 12,000

Profit as per marginal costing 52,000 44,000 60,000 76,000 2,32,000

* In quarter III: [6000 – 2000] × ` 2 = ` 8,000, Quarter IV = 2,000 × ` 2 = ` 4,000

Problem 2:

For a particular product, the following cost data is given:

Per unit (`)

Selling Price 20

Variable cost 12

Fixed cost 4

Normal production 52000 units

For the four consecutive periods, the following additional data are given:

Period 1 Period 2 Period 3 Period 4 Total

Units Units Units Units Units

Opening stock – - 12000 4000 -

Production 52000 60000 48000 60000 220000

Sales 52000 48000 56000 64000 220000

Closing stock - 12000 4000 - -

Prepare a statement showing the profit for different periods under both marginal costing method

& absorption costing method.

Solution:

Under Marginal Costing

Particulars Period 1 Period 2 Period 3 Period 4 Total

(`) (`) (`) (`) (`)

Sales – (i) 1040000 960000 1120000 1280000 4400000

Opening stock - - 144000 48000 -

Production 624000 720000 576000 720000 2640000

Total 624000 720000 720000 768000 2640000

Contd...

Less: Closing stock - 144000 48000 -

Cost of goods Sold (ii) 624000 576000 672000 768000 2640000

LOVELY PROFESSIONAL UNIVERSITY384000

50 Contribution (i) – (ii) 416000 448000 512000 1760000

Less: Fixed Cost 52000 units @ 4 208000 208000 208000 208000 832000

Profit 208000 176000 240000 304000 928000