Page 56 - DCOM206_COST_ACCOUNTING_II

P. 56

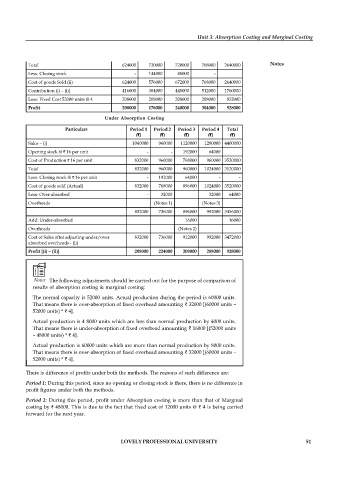

Particulars Period 1 Period 2 Period 3 Period 4 Total

(`) (`) (`) (`) (`)

Unit 3: Absorption Costing and Marginal Costing

Sales – (i) 1040000 960000 1120000 1280000 4400000

Opening stock - - 144000 48000 -

Production 624000 720000 576000 720000 2640000

Total 624000 720000 720000 768000 2640000 Notes

Less: Closing stock - 144000 48000 -

Cost of goods Sold (ii) 624000 576000 672000 768000 2640000

Contribution (i) – (ii) 416000 384000 448000 512000 1760000

Less: Fixed Cost 52000 units @ 4 208000 208000 208000 208000 832000

Profit 208000 176000 240000 304000 928000

Under Absorption Costing

Particulars Period 1 Period 2 Period 3 Period 4 Total

(`) (`) (`) (`) (`)

Sales – (i) 1040000 960000 1120000 1280000 4400000

Opening stock @ ` 16 per unit - - 192000 64000

Cost of Production ` 16 per unit 832000 960000 768000 960000 3520000

Total 832000 960000 960000 1024000 3520000

Less: Closing stock @ ` 16 per unit - 192000 64000 - -

Cost of goods sold (Actual) 832000 768000 896000 1024000 3520000

Less: Over-absorbed - 32000 32000 64000

Overheads (Notes 1) (Notes 3)

832000 736000 896000 992000 3456000

Add: Under-absorbed 16000 16000

Overheads (Notes 2)

Cost of Sales after adjusting under/over 832000 736000 912000 992000 3472000

absorbed overheads - (ii)

Profit [(i) – (ii)] 208000 224000 208000 288000 928000

Notes The following adjustments should be carried out for the purpose of comparison of

results of absorption costing & marginal costing:

The normal capacity is 52000 units. Actual production during the period is 60000 units.

That means there is over-absorption of fixed overhead amounting ` 32000 [(60000 units –

52000 units) * ` 4].

Actual production is 4 8000 units which are less than normal production by 4000 units.

That means there is under-absorption of fixed overhead amounting ` 16000 [(52000 units

– 48000 units) * ` 4].

Actual production is 60000 units which are more than normal production by 8000 units.

That means there is over-absorption of fixed overhead amounting ` 32000 [(60000 units –

52000 units) * ` 4].

There is difference of profits under both the methods. The reasons of such difference are:

Period 1: During this period, since no opening or closing stock is there, there is no difference in

profit figures under both the methods.

Period 2: During this period, profit under Absorption costing is more than that of Marginal

costing by ` 48000. This is due to the fact that fixed cost of 12000 units @ ` 4 is being carried

forward for the next year.

LOVELY PROFESSIONAL UNIVERSITY 51