Page 86 - DCOM206_COST_ACCOUNTING_II

P. 86

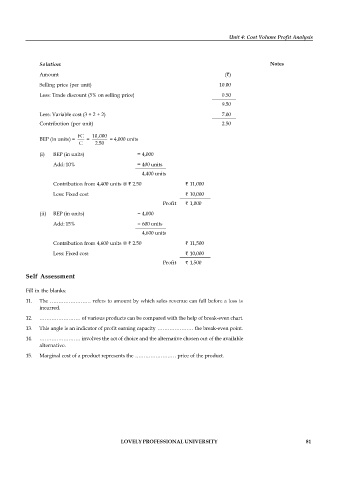

Unit 4: Cost Volume Profit Analysis

Solution: Notes

Amount (`)

Selling price (per unit) 10.00

Less: Trade discount (5% on selling price) 0.50

9.50

Less: Variable cost (3 + 2 + 2) 7.00

Contribution (per unit) 2.50

10,000

BEP (in units) = = = 4,000 units

2.50

(i) BEP (in units) = 4,000

Add: 10% = 400 units

4,400 units

Contribution from 4,400 units @ ` 2.50 ` 11,000

Less: Fixed cost ` 10,000

Profit ` 1,000

(ii) BEP (in units) = 4,000

Add: 15% = 600 units

4,600 units

Contribution from 4,600 units @ ` 2.50 ` 11,500

Less: Fixed cost ` 10,000

Profit ` 1,500

Self Assessment

Fill in the blanks:

11. The …………………… refers to amount by which sales revenue can fall before a loss is

incurred.

12. …………………… of various products can be compared with the help of break-even chart.

13. This angle is an indicator of profit earning capacity ………………… the break-even point.

14. …………………… involves the act of choice and the alternative chosen out of the available

alternative.

15. Marginal cost of a product represents the …………………… price of the product.

LOVELY PROFESSIONAL UNIVERSITY 81