Page 83 - DCOM206_COST_ACCOUNTING_II

P. 83

Cost Accounting – II

Notes In marginal costing, the offer may be accepted, if the quoted sales price is above marginal

cost, because of the reason that existing business contribution can recover the fixed cost

and the margin of profits. In such cases, the contribution made by bulk orders will be an

addition to the profit. But the sales price should not be less than the marginal cost. However,

it should not affect the normal market price.

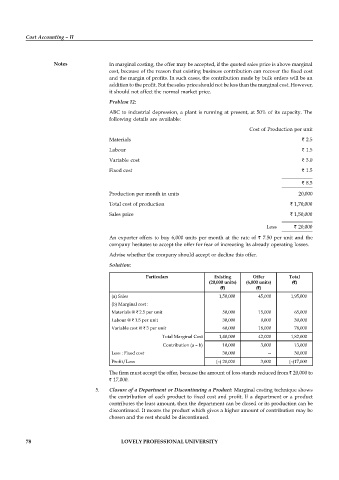

Problem 12:

ABC to industrial depression, a plant is running at present, at 50% of its capacity. The

following details are available:

Cost of Production per unit

Materials ` 2.5

Labour ` 1.5

Variable cost ` 3.0

Fixed cost ` 1.5

` 8.5

Production per month in units 20,000

Total cost of production ` 1,70,000

Sales price ` 1,50,000

Loss ` 20,000

An exporter offers to buy 6,000 units per month at the rate of ` 7.50 per unit and the

company hesitates to accept the offer for fear of increasing its already operating losses.

Advise whether the company should accept or decline this offer.

Solution:

Particulars Existing Offer Total

(20,000 units) (6,000 units) (`)

(`) (`)

(a) Sales 1,50,000 45,000 1,95,000

(b) Marginal cost :

Materials @ ` 2.5 per unit 50,000 15,000 65,000

Labour @ ` 1.5 per unit 30,000 9,000 39,000

Variable cost @ ` 3 per unit 60,000 18,000 78,000

Total Marginal Cost 1,40,000 42,000 1,82,000

Contribution (a – b) 10,000 3,000 13,000

Less : Fixed cost 30,000 -- 30,000

Profit/Loss (–) 20,000 3,000 (–)17,000

The firm must accept the offer, because the amount of loss stands reduced from ` 20,000 to

` 17,000.

5. Closure of a Department or Discontinuing a Product: Marginal costing technique shows

the contribution of each product to fixed cost and profit. If a department or a product

contributes the least amount, then the department can be closed or its production can be

discontinued. It means the product which gives a higher amount of contribution may be

chosen and the rest should be discontinued.

78 LOVELY PROFESSIONAL UNIVERSITY