Page 57 - DMGT405_FINANCIAL%20MANAGEMENT

P. 57

Unit 3: Sources of Finance

manager, etc. The company provides fund based as well as non-fund based financial Notes

solutions to both wholesale and retail segments.

DLF Ltd. has been approached by A Ltd., Mumbai, for financial help. A Ltd. manufacturers

process system for food processing, pharmaceuticals, engineering, dairy and chemical

industries. A wide range of centrifugal separators, plate, spray drudgers, custom fabricated

equipment for exotic metals, refrigeration compressors, are also manufactured by the

company. One of the major strengths of the company is project management.

A Ltd. has a well-equipped R&D centre. It has pilot plant facilities and a modern laboratory

for chemical, metallurgical and mechanical analyser. The company has also set up a

technology centre with advanced testing facilities. Recently, the manager of the technology

centre has requisitioned for the acquisition of computerised sophisticated equipment for

conducting important tests.

The equipment is likely to have the useful life of three years. The cost of the equipment is

10 crore. The scrap value of the equipment at the end of its useful life will be zero for the

company. The finance manager of A Ltd. has suggested that the company should take a

loan for three years from a commercial bank. Repayment of the loan would be made at the

end of each year in three equal instalments. The repayments would comprise of the

(i) principal, and (ii) interest at 10% p.a. (on the outstanding amount in the beginning of

the year). A Ltd. uses a cost of capital of 15% to evaluate the investments of this type. The

equipment will be depreciated @ 33.3% p.a. (WDV).

P. Securities Ltd. has agreed to give the equipment to the company on a three-year lease.

The annual rental for the lease, payable in the beginning of each year, would be 4 crore.

P. Securities Ltd. discounts its cash flows @ 14%. The equipment is depreciable at 33.3% p.a.

(straight line method). The lessee may exercise its option to purchase the equipment for 4

crore at the termination of the lease.

A Ltd. would bear all maintenance, insurance and other charges in both the alternatives.

Both the companies pay tax @ 35%.

You are a practicing Company Secretary. You are approached by the Managing Director of

A Ltd. to help the company in evaluating the proposal.

Prepare a report for the Managing Director of A Ltd. showing the effect of the lease

alternative on the wealth of its shareholders. Support your answer with appropriate

calculations.

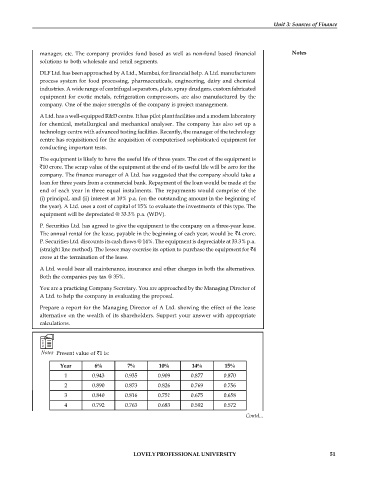

Notes Present value of 1 is:

Year 6% 7% 10% 14% 15%

1 0.943 0.935 0.909 0.877 0.870

2 0.890 0.873 0.826 0.769 0.756

3 0.840 0.816 0.751 0.675 0.658

4 0.792 0.763 0.683 0.592 0.572

Contd...

LOVELY PROFESSIONAL UNIVERSITY 51