Page 132 - DMGT405_FINANCIAL%20MANAGEMENT

P. 132

Financial Management

Notes

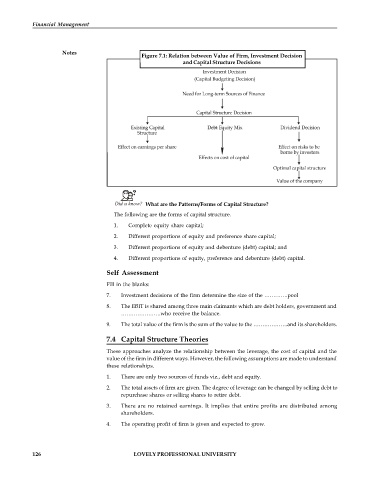

Figure 7.1: Relation between Value of Firm, Investment Decision

and Capital Structure Decisions

Did u know? What are the Patterns/Forms of Capital Structure?

The following are the forms of capital structure.

1. Complete equity share capital;

2. Different proportions of equity and preference share capital;

3. Different proportions of equity and debenture (debt) capital; and

4. Different proportions of equity, preference and debenture (debt) capital.

Self Assessment

Fill in the blanks:

7. Investment decisions of the firm determine the size of the ………….pool

8. The EBIT is shared among three main claimants which are debt holders, government and

………………….who receive the balance.

9. The total value of the firm is the sum of the value to the ……………….and its shareholders.

7.4 Capital Structure Theories

These approaches analyze the relationship between the leverage, the cost of capital and the

value of the firm in different ways. However, the following assumptions are made to understand

these relationships.

1. There are only two sources of funds viz., debt and equity.

2. The total assets of firm are given. The degree of leverage can be changed by selling debt to

repurchase shares or selling shares to retire debt.

3. There are no retained earnings. It implies that entire profits are distributed among

shareholders.

4. The operating profit of firm is given and expected to grow.

126 LOVELY PROFESSIONAL UNIVERSITY