Page 223 - DMGT405_FINANCIAL%20MANAGEMENT

P. 223

Unit 10: Working Capital Management

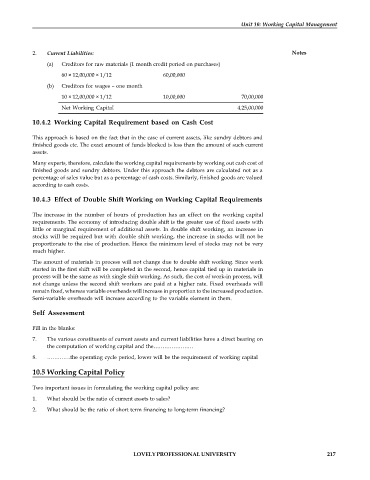

2. Current Liabilities: Notes

(a) Creditors for raw materials (1 month credit period on purchases)

60 × 12,00,000 × 1/12 60,00,000

(b) Creditors for wages – one month

10 × 12,00,000 × 1/12 10,00,000 70,00,000

Net Working Capital 4,25,00,000

10.4.2 Working Capital Requirement based on Cash Cost

This approach is based on the fact that in the case of current assets, like sundry debtors and

finished goods etc. The exact amount of funds blocked is less than the amount of such current

assets.

Many experts, therefore, calculate the working capital requirements by working out cash cost of

finished goods and sundry debtors. Under this approach the debtors are calculated not as a

percentage of sales value but as a percentage of cash costs. Similarly, finished goods are valued

according to cash costs.

10.4.3 Effect of Double Shift Working on Working Capital Requirements

The increase in the number of hours of production has an effect on the working capital

requirements. The economy of introducing double shift is the greater use of fixed assets with

little or marginal requirement of additional assets. In double shift working, an increase in

stocks will be required but with double shift working, the increase in stocks will not be

proportionate to the rise of production. Hence the minimum level of stocks may not be very

much higher.

The amount of materials in process will not change due to double shift working. Since work

started in the first shift will be completed in the second, hence capital tied up in materials in

process will be the same as with single shift working. As such, the cost of work-in process, will

not change unless the second shift workers are paid at a higher rate. Fixed overheads will

remain fixed, whereas variable overheads will increase in proportion to the increased production.

Semi-variable overheads will increase according to the variable element in them.

Self Assessment

Fill in the blanks:

7. The various constituents of current assets and current liabilities have a direct bearing on

the computation of working capital and the………………….

8. ………….the operating cycle period, lower will be the requirement of working capital

10.5 Working Capital Policy

Two important issues in formulating the working capital policy are:

1. What should be the ratio of current assets to sales?

2. What should be the ratio of short term financing to long-term financing?

LOVELY PROFESSIONAL UNIVERSITY 217